Subscribe

Sign up to receive the Publicis Groupe newsletter

Sections

Date of publication

No results were found for your search

Subscribe

Sign up to receive the Publicis Groupe newsletter

10/20/2016, Paris

Publicis Groupe’s revenue at September 30, 2016 was up 5.2% when exchange rates are factored out. Organic growth for the period was 1.9%.

« Publicis Groupe’s revenue at September 30, 2016 was up 2.9% over the corresponding period in 2015, and by 5.2% when exchange rates are factored out. Organic growth for the period was 1.9%. Unsurprisingly, growth decelerated in the third quarter to 0.2%. As announced, the third and fourth quarters of the year are the most significantly impacted by accounts lost in the media palooza. This was compounded by projects recently completed at Razorfish that will only be relayed by new projects in the fourth quarter, but that will produce their full effect in 2017. Therefore, on the geographical standpoint, North America showed a sharp downturn (-4.0%) while Europe reported a strong growth (+7.6%).

As anticipated, it is in 2017 that we will reap the full benefits of the new “Power of One” organization we are implementing. The initial results are already there, as evidenced by the large accounts awarded to us by advertisers such as Wal-Mart, GSK, HPE, Coty and USAA. It is worth noting "The Power of One" has been very successful at Razorfish which experienced the best ever quarter for new business.

Regarding the fourth quarter, like every year, economic uncertainties can result in marketing investments becoming the adjustment variable in the equation towards the end of the year. We have nonetheless confidence in our ability to reach our objectives, which is why the Management Board has moved that the 42% payout ratio we had been targeting for 2018 be decided as of 2016.

As indicated quite some time ago, the formal process of identifying my successor will commence in November, leading to a decision to be taken by the Supervisory Board, no later than at its meeting of February 2017. »

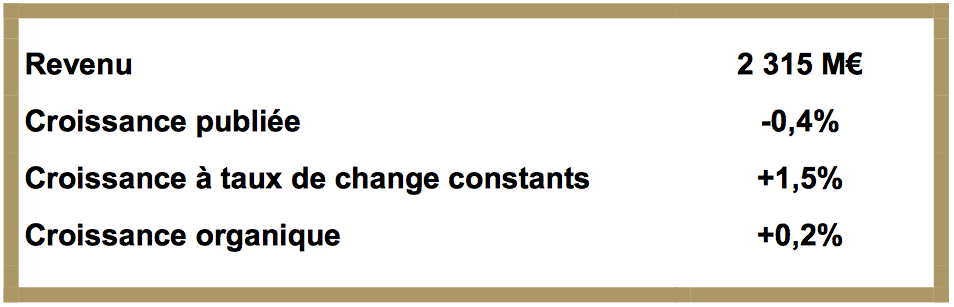

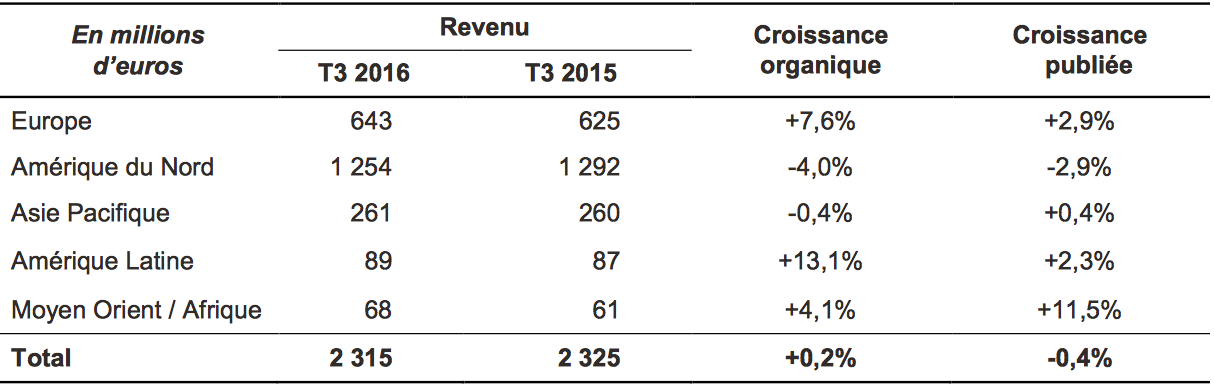

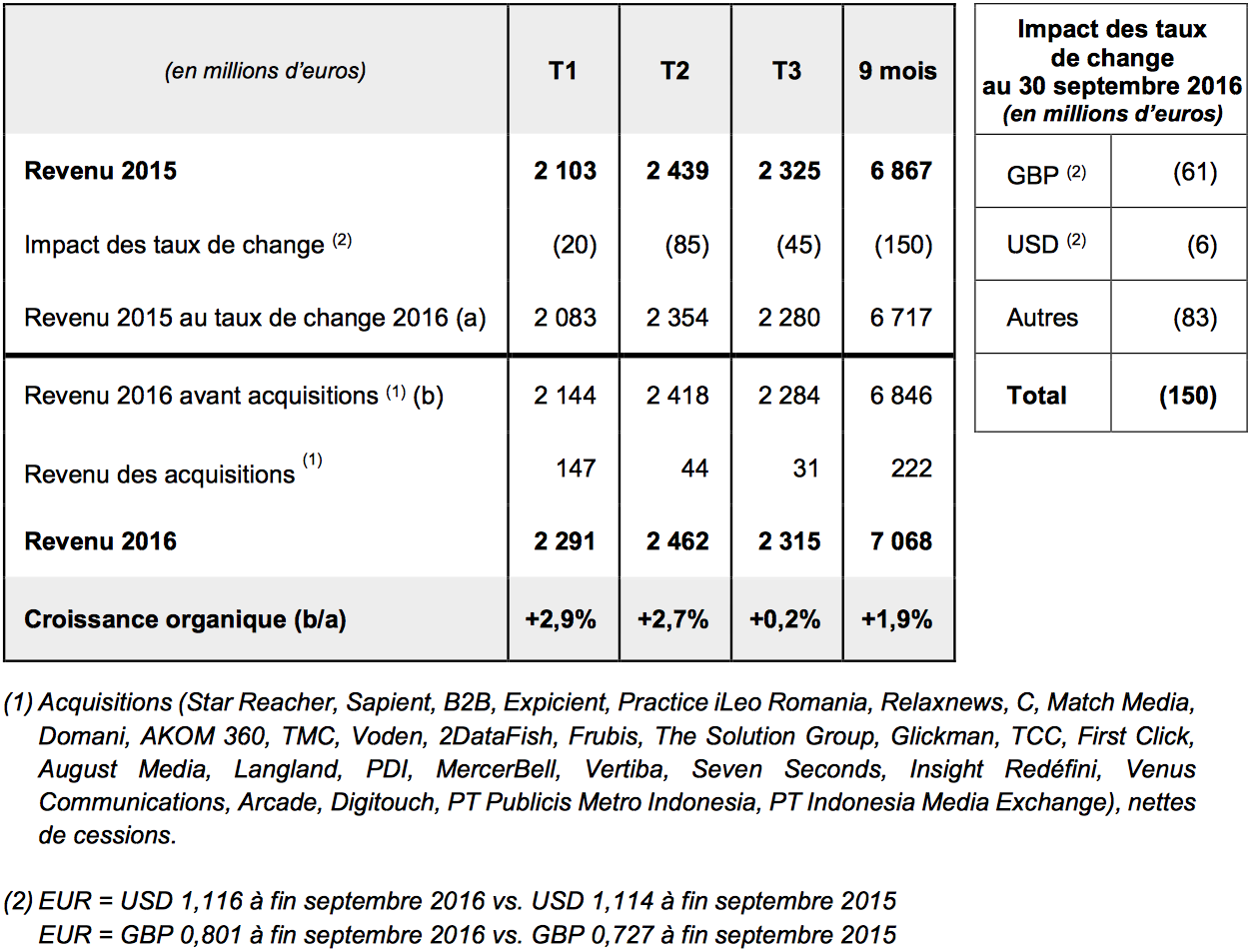

Publicis Groupe’s consolidated revenue for the third quarter of 2016 was 2,315 million euro, 0.4% below the 2,325 million euro reported for the corresponding period in 2015. Exchange rates impacted revenue negatively by 45 million euro, i.e. the equivalent of 1.9% of Q3 2015 revenue. Net acquisitions contributed 31 million euro to revenue in Q3 2016, i.e. the equivalent of 1.3% of Q3 2015 revenue. Growth at constant exchange rates was +1.5%.

Organic growth was +0.2% in the third quarter, below the growth rate at June 30 due to the more significant impact of media accounts lost in the 2015 media palooza – an impact that will remain high in Q4 – and to the end of several digital projects when new projects have not reached their full growth potential yet.

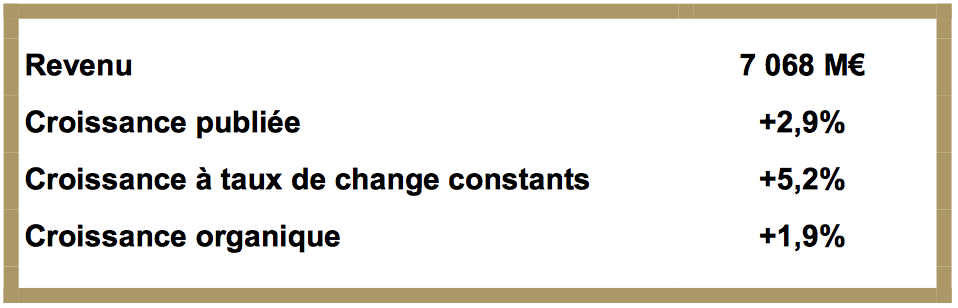

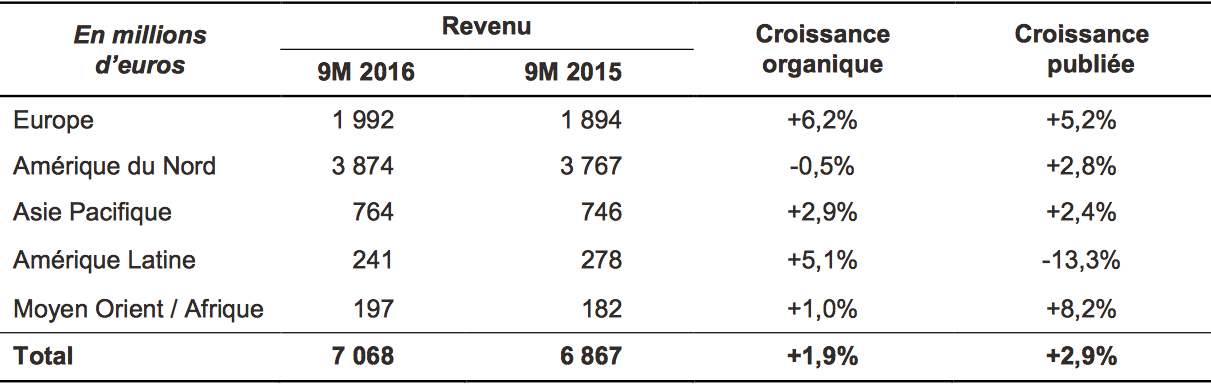

In the first nine months of 2016, Publicis Groupe’s consolidated revenue totaled 7,068 million euro, up 2.9% from 6,867 million euro for the corresponding period in 2015. Exchange rates adversely affected revenue by 150 million euro, i.e. the equivalent of 2.2% of revenue for the first nine months of 2015. Net acquisitions contributed 222 million euro during the first nine months, i.e. the equivalent of 3.2% of 2015 revenue for the same period. Growth at constant exchange rates was +5.2%, and organic growth stood at +1.9% at September 30, 2016.

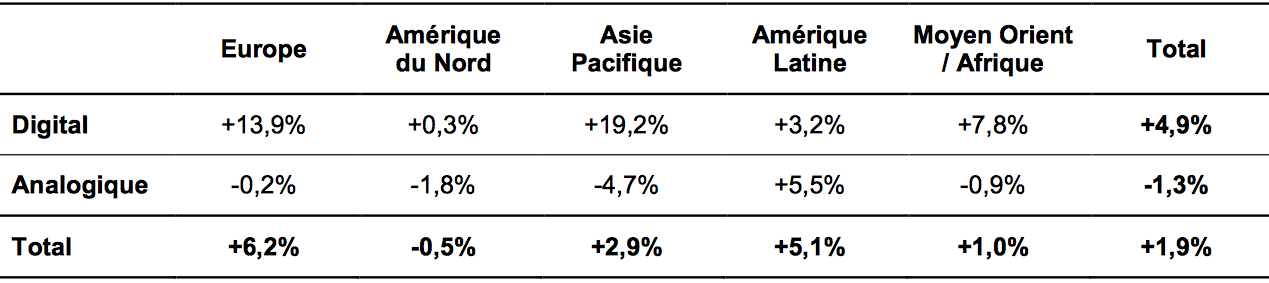

Europe’s revenue grew by 5.2%. When the impact of acquisitions and exchange rates is factored out, organic growth stands at +6.2%, with a strong performance in France (above 5%), and strong momentum in Germany and Italy (growth of close to 10%), helped by a more conducive macroeconomic environment. The situation was volatile in Russia where growth stood at more than 9% at September 30 after growth of almost 5% in the first half year. The UK has picked up sharply and recorded growth of almost 5% (including +7% in the third quarter). Digital continued to post high growth in Europe generally (+13.9%)

North America reported growth of 2.8% at September 30, though organic growth was -0.5% (organic growth was -4.0% in the third quarter). This downturn was attributable to media subsequent to the loss of certain media accounts in the 2015 media palooza, as well as the end of several digital projects at a time when new projects have not reached their full growth potential yet.

Asia Pacific reported growth of 2.4% (organic growth of 2.9%), with especially satisfactory performance levels in China and India.

Latin America was down 13.3% on a reported basis mainly due to exchange rates as this area recorded positive organic growth of 5.1%. Brazil picked up to record strong revenue growth of 10.9% in the third quarter, and Mexico continued to boast high growth (+20.5% in Q3 after 11.5% in the first half year).

The Middle East & Africa achieved reported growth of 8.2% and organic growth of 1.0%.

The Groupe’s growth continued to be driven by its digital activities (organic growth of +4.9%), with double-digit growth in Europe and Asia Pacific. North America only grew by +0.3% due to the media account losses of 2015 and the end of several digital projects when new projects have been recorded a slow start. Despite the Q3 slowdown of organic growth that can be ascribed to the very strong comparable period in 2015, Sapient continues to be buoyed posting a satisfactory growth rate at September 30. It should also be pointed out that analog activities continued to decline.

At September 30, 2016, net debt amounted to 2,452 million euro, compared with 1,872 million euro at December 31, 2015. The Groupe’s average net debt at September 30, 2016 was 2,443 million euro after 2,305 million euro at September 30, 2015. It should be recalled that the Sapient acquisition was completed on February 6, 2015.

4.1 - Transformation

During the first half of 2016, Publicis Groupe ended the traditional structure of the holding company and silos and has reorganized its operations by putting clients at the heart of the Groupe. Thus, clients have access to all the Groupe's capabilities (“The Power of One”) to meet their needs in commerce, marketing or transformation.

The Groupe should reap the benefits of this organization in the forthcoming quarters. The initial results are very promising with accounts gained that include Wal-Mart, P&G’s home care brands, Asda, GSK, HPE and USAA.

4.2 – Digital

Activities in digital and technology now represent 54% of Groupe revenue. The Sapient integration is going well and its performance is very satisfactory. Razorfish, which suffered headwinds for several quarters, recorded in the third quarter its best quarter ever in terms of new business in its history thanks to the support of Sapient and “The Power of One”.

4.3 – Groupe commitment to start-ups

4.4 – Global partnership with Tencent

Publicis Groupe has entered into a strategic partnership with Tencent, the internet giant that operates the most popular social and media platforms in China. This partnership is a first-of-its-kind collaboration between a global communications group and China’s biggest internet company. It spans the Groupe’s three solutions hubs (Publicis Media, Publicis Communications and Publicis.Sapient) as well as Tencent’s eleven product lines. This agreement will cement the groups’ relationship at a global level while providing clients with access to all Tencent’s innovative solutions via a unique, borderless approach built on three pillars:

a tremendous capacity for innovation: through this partnership, Publicis Groupe and Tencent will launch an incubation facility in China called “Drugstore”. The goal is to curate, invest in and cultivate the start- ups of the future. This will provide breakthrough offerings to our clients in data and ad tech, as well as across new virtual reality (VR) and augmented reality (AR) platforms;

an exceptional source of data: Publicis Groupe will have access to digital behavior databases that will benefit its clients through improved programmatic offerings and cross-screen planning capabilities;

innovative web content: the two companies will partner on the creation and co-investment of web-native content to drive unique content opportunities and new content models for key clients.

4.5 - Acquisitions

MercerBell is a leading Australian agency in the field of customer experience. MercerBell is specialized in CRM and digital strategy, creativity, content and technology, and will be integrated into Saatchi & Saatchi. This agency, which was founded in 1999, has a team of 65 professionals and a customer base that includes Toyota, Foxtel, Quantas, BT, Allianz and ASX.

Vertiba, the Salesforce partner, is specialized in marketing solutions. Founded in 2010, Vertiba is headquartered in Boulder, Colorado. Vertiba’s skills will be integrated into the Publicis.Sapient platform.

Seven Seconds, the London (UK) based e-commerce and digital specialist, was founded in 2013 and will be integrated into BBH. Its main clients are British Airways, Barclays, Boots, Tesco Retail and Tesco Bank.

Venus Communications is one of the leading public relations agencies in Vietnam. Venus has been integrated into the MSL brand, which in turn is part of Publicis One in Vietnam. Over the last 10 years, Venus and MSL have worked together successfully on numerous assignments. The agency, which was founded in 1998, has over 40 employees and a prestigious client portfolio that includes MasterCard, FedEx, Rolls Royce, BAT, Mead Johnson and Sanofi.

Troyka Group, in which Publicis Groupe has taken a stake, is West Africa’s first fully-integrated communications services group. The Troyka group is comprised of six agencies, i.e. Insight Communications, The Thinkshop, All Seasons Media, Media Perspectives, The Quadrant Company, and Hotsauce. Starting out with Insight Communications in 1980, the Troyka group now has 300 employees over six agencies across the entire region. The Troyka agencies work with prestigious international brands such as Heineken, Shell, Samsung, Unilever, Google, P&G, Microsoft, Ford and Axa, as well as with national brands including Oando, Nestoil, Africa Investor, Jagal, and Olam. Publicis Groupe has been investing regularly in Africa in recent years, in view of the high growth potential of this market. By way of this equity investment, Publicis Groupe will use Troyka to launch its network in Nigeria, thereby creating a powerful communications entity that will have a competitive edge in all skill sets in West Africa.

The Groupe’s transformation is the most radical ever imagined in its sector. It is being carried out to meet clients’ new requirements in selling their products or in their own transformation. Publicis Groupe has abolished the notion of holding company with silo-type operating structures. The results to date, obtained with the implementation of the new “Power of One” organization, have been very promising, with accounts gained including Wal-Mart, Asda, P&G’s home care products, GSK, HPE, Coty and USAA.

Publicis Groupe is confirming its previous guidance for 2016 in spite of the 250 to 300 basis point negative impact on the growth of the second half of 2016. On top, the fourth quarter is usually characterized by uncertainty surrounding advertisers’ budget management. We approach 2017 cautiously given the lack of visibility owing to elections in the US, France and Germany, and the consequences of “Brexit”, not just for the UK for also for the rest of Europe.

The Management Board will be proposing that the 2018 objective of a 42% payout (compared with 39.5% in 2015) be brought forward in respect of financial 2016.

Certain information contained in this document, other than historical information, may constitute forward-looking statements or unaudited financial forecasts. These forward-looking statements and forecasts are subject to risks and uncertainties that could cause actual results to differ materially from those projected. They are presented as at the date of this document and, other than as required by applicable law, Publicis Groupe does not assume any obligation to update them to reflect new information or events or for any other reason. Publicis Groupe urges you carefully to consider the risk factors that may affect its business, as set out in the 2015 Registration Document filed with the French Autorité des Marchés Financiers (AMF) and which is available on the website of Publicis Groupe (www.publicisgroupe.com), including an unfavorable economic climate, an extremely competitive market sector, the possibility that our clients could seek to terminate their contracts with us at short notice, the fact that a substantial part of the Group’s revenue is derived from certain key clients, conflicts of interest between advertisers active in the same sector, the Group’s dependence on its directors and employees, laws and regulations which apply to the Group’s business, legal action brought against the Group based on allegations that certain of the Group’s commercials are deceptive or misleading or that the products of certain clients are defective, the strategy of growing through acquisitions, the depreciation of goodwill and assets listed on the Group’s balance sheet, the Group’s presence in emerging markets, the difficulty of ensuring internal controls, exposure to liquidity risk, a drop in the Group’s credit rating and exposure to the risks of financial markets.

Volkswagen (China), Mondelez gum & candy (China), Wetherm (Greater China), Marubi (Greater China), Snapdeal (India), Yakult (Brazil), Carrefour (Brazil), Wine (Brazil), Movida (Brazil), Cadillac (USA), P&G Dish (USA), Acer Global (South Africa), Morrisons (UK), P&G (UK), Nestlé (UK), Belimo (Switzerland), Duracell International (Poland), Samsung / Brown Goods (Poland), Mlekpol (Poland), Experian (UK), Asda (UK), Netflix (USA), Macy's (USA), Marubi (China), BAIC international (China), L'Oréal (China), Petco (China), Health Promotion Board (Singapore), Snapdeal (India), Yakult (Brazil), Carrefour (Brazil), WINE (Brazil), Lactalis (Brazil), Movida (Brazil), Ladbrokes (Australia), Walmart (USA), Experian (UK), Omantel (United Arab Emirates), Sberbank (Russia), Porto Seguro (Brazil), Mondelez –Tang (Brazil), Hewlett Packard Enterprise (USA), Hyundai (China), Nissan (China), Huawei (China), ampm convenience stores – BP (USA), USAA (USA)

Shine Lawyers (Australia), Metricon Homes (Australia), EziBuy (Australia), AFL (Australia), Crosby Texter (Australia), BMBS/Daimler (China), DBS (Singapore/China/India), Shangri-La (China/Hong Kong), EDB (Ingapore), Urban Clap (India), Gander Mountain (USA), Snapchat (USA), THE One (UAE/GCC), Lidl (Denmark), ORCHESTRA (France), VTECH (France), FinexKap (France), Generali (Switzerland), INLAC (Spain), Worten (Spain), Pepe Jeans (Spain), 4 Finance (Poland), SAB Miller (Poland), OBI (Poland), Frisco (Poland), Nomad Foods (Europe), Deutsche Bahn (Germany), Masmovil (Spain), Asda (UK), Anacor Pharmaceuticals (USA), Discover (USA), Dole (USA), Groupon (USA), Motorola (USA), SGM (China), Tmall/Alibaba (China), YouXin (China), Coca Cola (Russia), The Study Group (Australia), DJI (Global), Aviva (Global), Air France (Global SEO), 888.com (Germany & Spain), Airbnb (Canada), Chick-fil-A (USA), Coty (Global), Dole Food (USA), eBay (USA), Ego Pharmaceuticals (Australia), eOne (Global), First Niagara Financial (USA), Foxtel (Australia), Hospital Corporation of America (USA), HP Enterprise (USA), Kayak (France), MYOB (Australia), Nostromo (Italy), OLX Inc (India), Percept H (Toyota) (India), Santa Lucia (Spain), Tmall (Alibaba) (China), USAA (USA), Wingstop (USA)

Mastercard (Australia), Sunsuper (Australia), Pinpoint (Australia), Angie’s List (USA), Time Inc. (USA), Whole Foods (USA), Travelers (USA), Cardinal Health (USA), Genetech (USA), TransAmercia (USA), J Jill (USA), Silicon (USA), Starbucks (USA), CSM Bakery (USA), Manulife (Canada), Kering (UK), PGA Europe (UK), Congstar (Germany), Clinique Men (USA), ABBVie (USA), HCA (UK), CBL & Associates Properties (USA), Michael Kors (USA), Huawei (China), RBS (UK), Gallagher Bassett (USA), Cybersource (USA), UPS (USA), Cigna (USA), Wakefern (USA), USC Shoah Foundation (USA), Kelloggs (UK), Under Amour (USA), Sony (USA), Kellogg (UK), Glidden (USA), Hewlett Packard Enterprises (USA), USAA (USA)

Acer (Indonesia), Electronic City (Indonesia), JDID (Indonesia), Scotiabank (Chile), Histadrut (Israel), Arkia (Israel), Mediamarkt (Turkey), BSH Ikiakes Syskeves A.B.E. (Greece), Nestlé (Greece), Newsphone Hellas (Greece), Dutch Government (Netherlands), Meetic (Netherlands), Cortefiel (Belgium), MCM (Belgium), NortSails (Belgium), Teva (Belgium), Walmart (Guatemala), Ferrero (Romania), Newsphone Hellas (Greece), Histadrut (Israel), Arkia (Israel), Cheli Maman (Israel), Anti-Drug Association (Israel), Scotiabank (Chile)

13-01-2016 - Publicis Communications Announces Priorities & Key Appointments

28-01-2016 - Leadership change at Leo Burnett Worldwide

11-02-2016 - 2015 annual results

03-03-2016 - Publicis.Sapient acquires Vertiba, a Salesforce Gold Consulting Partner

10-03-2016 - MSL acquires Venus Communications Ltd in Vietnam

10-03-2016 - Publicis Media Unfolds Its Organisation Powered by Four Global Brands - Starcom, Zenith, Mediavest | Spark, and Optimedia | Blue 449

17-03-2016 - Publicis Groupe Partners with The Troyka Group in Nigeria

24-03-2016 - Publicis Groupe Launches Sapient Inside: The Combined Power of Publicis Communications and the Publicis.Sapient Platform

31-03-2016 - Publicis Groupe Named the Most Attractive Employer in the Services Sector by the Randstad Awards

31-03-2016 - Publicis One Announces its Global and Regional Leadership

21-04-2016 - Q1 2016 revenue

28-04-2016 - Publicis One announces its local leadership in Philippines

18-05-2016 - Publicis Media announces leadership in France

25-05-2016 - Combined General Shareholders’ Meeting

01-06-2016 - Publicis Groupe announces Chief Revenue Officer’s sabbatical to deal with family issue. Laura Desmond to return January 1, 2017

01-06-2016 - Decision by JCDecaux to abandon its proposed acquisition of 67% of the Metrobus share capital held by Publicis Groupe

07-06-2016 - ANA Report: Publicis Groupe Statement

13-06-2016 - Agreement with Samsung to end the discussions regarding a possible investment in Cheil Wordwide alongside associated collaboration

01-07-2016 - Publicis90: Publicis Groupe is Financing 90 Startups at #vivatech

01-07-2016 - Publicis Groupe and Tencent Sign Historic Global Partnership

12-07-2016 - Publicis Groupe and Walmart Stores, Inc. Launch a Strategic Relationship

21-07-2016 - First half 2016 results

03-08-2016 - Resignation of Kevin Roberts Head Coach de Publicis Groupe, Executive Chairman of Saatchi & Saatchi/Fallon, Member of the Management Board

14-09-2016 - Appointment of Valérie Decamp as CEO of Metrobus, and of Gérard Unger as Non- Executive Chairman

22-09-2016 - Publicis Communications Announces Key Appointments as It Accelerates on Its Transformation

EBITDA: operating margin before depreciation.

Operating margin: Revenue after personnel costs, other operating expenses (excl. non-current income and expense) and depreciation (excl. amortization of intangibles arising on acquisitions).

Operating margin rate: Operating margin as a percentage of revenue.

Headline Group Net Income: Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals and revaluation of earn-out payments

EPS (Earnings per share): Group net income divided by average number of shares, not diluted.

EPS, diluted (Earnings per share, diluted): Group net income divided by average number of shares,

diluted.

Headline EPS, diluted (Headline Earnings per share, diluted): Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals and revaluation of earn-out payments, divided by average number of shares, diluted.

Capex: Net acquisitions of tangible and intangible assets, excluding financial investments and other financial assets.

ROCE (Return On Capital Employed): Operating Margin after Tax (using Effective Tax Rate) / Average employed capital. Capital employed include Saatchi & Saatchi goodwill which is not recognised in consolidated accounts under IFRS.

Net Debt (or financial net debt): Sum of long and short financial debt and associated derivatives, net of treasury and cash equivalents.

Average net debt: Average of monthly net debt at end of month.

Dividend pay-out: Dividend per share / EPS.

Publicis Groupe [Euronext Paris FR0000130577, CAC 40] is a global leader in communication. The Groupe is positioned at every step of the value chain, from consulting to execution, combining marketing transformation and digital business transformation. Publicis Groupe is a privileged partner in its clients’ transformation to enhance personalization at scale. The Groupe relies on ten expertise concentrated within four main activities: Communication, Media, Data and Technology. Through a unified and fluid organization, its clients have a facilitated access to all its expertise in every market. Present in over 100 countries, Publicis Groupe employs around 101,000 professionals.

Jean-Michel Bonamy

Deputy CFO

jean-michel.bonamy@publicisgroupe.com

+ 33 (0) 1 44 43 74 88

Amy Hadfield

DIRECTOR OF GLOBAL COMMUNICATIONS PUBLICIS GROUPE