Subscribe

Sign up to receive the Publicis Groupe newsletter

Sections

Date of publication

No results were found for your search

Subscribe

Sign up to receive the Publicis Groupe newsletter

02/08/2018, Paris

The Groupe being in the midst of its own transformation, the quality of our results demonstrates Publicis Groupe’s strength and our ability to adapt to the deep changes affecting our industry. The Groupe is stronger than it was a year ago.

Arthur Sadoun, Chairman and CEO of Publicis Groupe:

“Despite a generally difficult context and the Groupe being in the midst of its own transformation, the quality of our results demonstrates Publicis Groupe’s strength and our ability to adapt to the deep changes affecting our industry. The Groupe is stronger than it was a year ago.

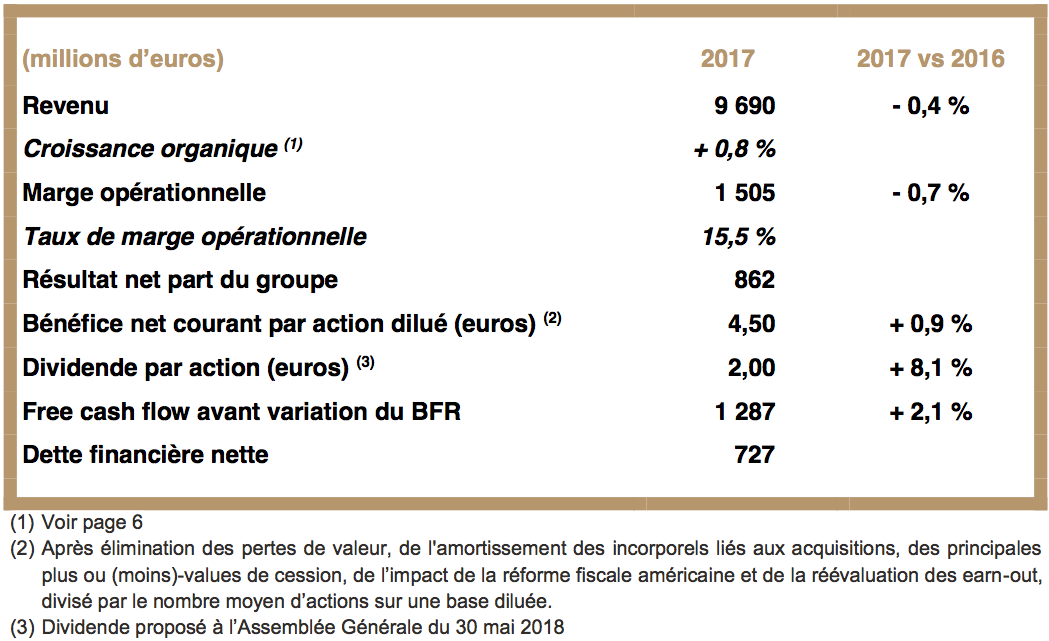

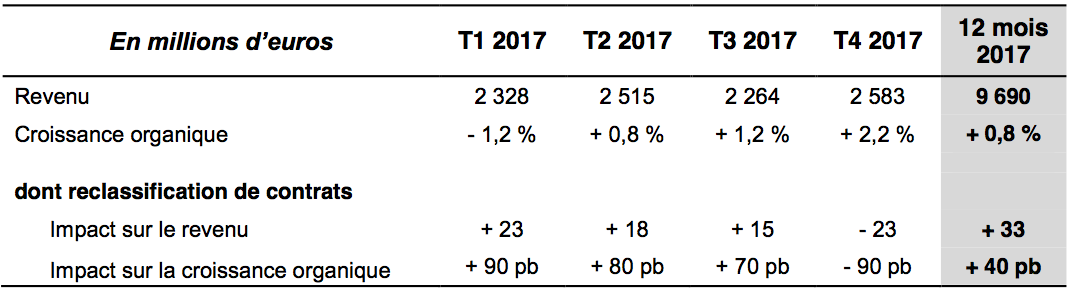

In the fourth quarter, organic growth reached +2.2%, continuing its sequential improvement from the beginning of the year. Organic growth rose from -1.2% in Q1 to +0.8% in Q2, and to +1.2% in Q3 2017. Over the full year, organic growth reached +0.8%, a slight improvement on 2016.

Importantly, we performed very well in the USA with organic growth of +4.5% in Q4 after +3.5% in Q3, largely driven by accounts won over the last 12 months. This sign is all the more encouraging in a country where our transformation is well advanced and where we generate over 50% of our revenue.

In 2017, we continued with our endeavors to reduce costs. Our margin rose to 15.5%, up 40 basis points over the previous year at constant restructuring costs. Operating margin in value was up at constant exchange rates. In this difficult context, we were determined to gain in competitiveness and we have clearly succeeded.

Finally, our free cash flow performance is noteworthy, rising to nearly 1.3 billion euro leading to a substantial reduction in our net debt to 727 million euro. As a result, debt related to the Sapient acquisition was significantly reduced.

I would like to thank all our people who have made this possible.

In an industry that is experiencing a fundamental upheaval, we need to further demonstrate the singularity of our model and why we are ideally positioned to partner our clients. In recent months, we reached several milestones in our transformation process.

We began by defining our vision, to become the leader in marketing and business transformation. Our offer combining data, content and technology is at the core of our clients’ needs. We are able to provide it at scale, in an integrated, seamless manner.

We are transforming ourselves from a holding company to a client-centric connecting platform, breaking down silos at country level and accelerating our own digital transformation. With Marcel, the future platform dedicated to all of Publicis Groupe’s talents and named after the Groupe’s founder, Marcel Bleustein-Blanchet, we are radically changing the way our people share, create and participate in Groupe projects. As we recently announced, we are also delighted to have Microsoft as partner for this ambition.

Our attractiveness in the market is underscored by new account wins such as P&G UK, Lionsgate, Southwest Airlines, L’Oréal, McDonald’s and Carrefour, but also by the arrival of new leaders such as Nick Law, the very recently appointed Groupe Chief Creative Officer. This positive momentum is further evidence that Publicis Groupe’s model is futureproof.

These early results are encouraging but there is still a lot to do. We now have solid foundations from which to build in 2018 to help our clients take on the essential challenges ahead.”

Publicis Groupe’s Supervisory Board met on February 7, 2018 and approved the 2017 results presented by the Management Board chaired by Arthur Sadoun. The Board expressed its satisfaction with the progress made on several fronts: the announced acceleration in growth was confirmed, results improved taking into account the exceptional costs, and, above all, the milestones reached in the transformation of Publicis Groupe have been very significant.

The Board is confident in the strategy pursued and the way the Groupe is conducted to address the challenges ahead.

BUSINESS ACTIVITY IN 2017

Digital is highly disruptive for relationships with media and consumers, but it has created numerous growth opportunities for Publicis Groupe and its clients. In this context, Publicis Groupe accelerates its own transformation and intends to be the indispensable partner clients need to transform their marketing and business models. Organic growth was modest in 2017, as expected, at +0.8%. The Groupe has taken steps to stimulate growth while keeping costs under strict control. As a result, operating margin improved at constant restructuring costs, while free cash flow improved once again.

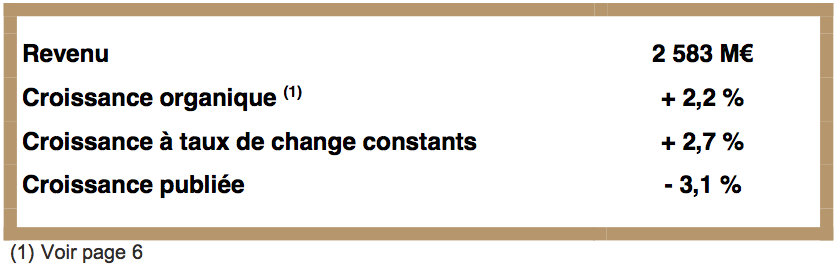

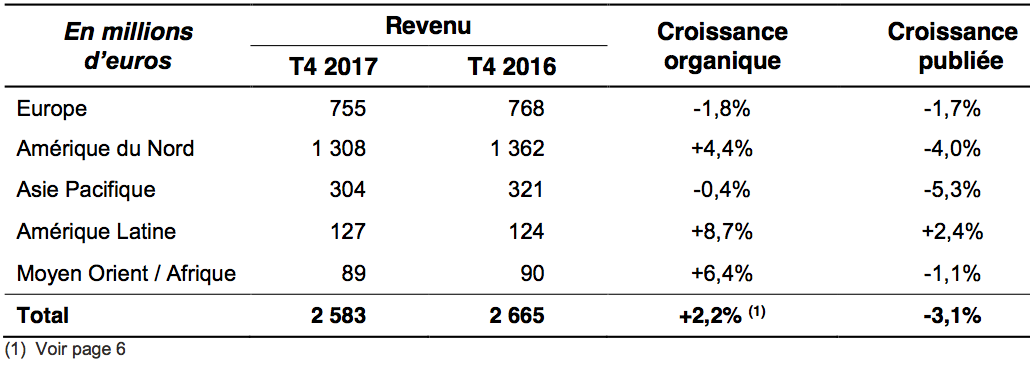

Q4 2017 Revenue

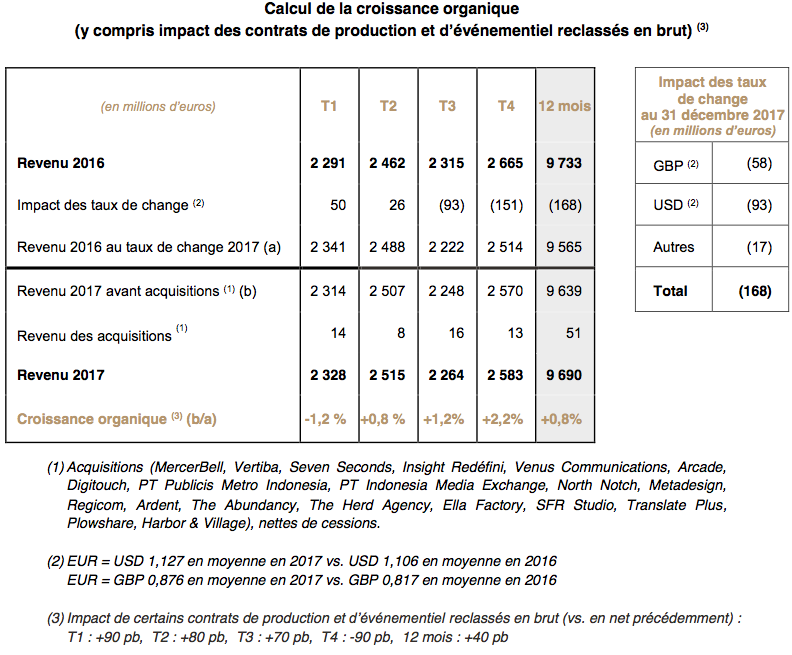

Publicis Groupe’s consolidated revenue in Q4 2017 was 2,583 million euro, down 3.1% from 2,665 million euro in 2016. Exchange rates had a 151 million euro negative impact, i.e. the equivalent of 5.7% of its revenue in Q4 2016. Net acquisitions contributed 13 million euro to revenue in Q4 2017, i.e. the equivalent of 0.5% of its Q4 2016 revenue. Growth at constant exchange rates was +2.7%.

Organic growth was +2.2% in Q4 2017, the third consecutive quarter of improved growth during the year after -1.2% in Q1 2017, +0.8% in Q2 2017 and +1.2% in Q3 2017. The Groupe benefited from the build-up of contributions from accounts awarded in the second quarter of 2016, including those of Synergy Pharmaceuticals, Walmart, USAA, Asda, Motorola and Lowe’s. In addition, Q4 2017 organic growth includes the impact of the reclassification on a “gross” basis of certain contracts in production and events (see details on page 6).

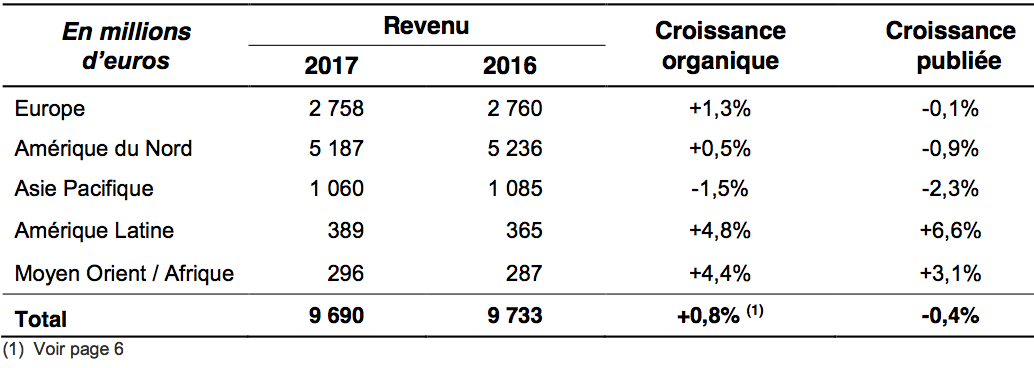

Publicis Groupe’s consolidated revenue in 2017 was 9,690 million euro, down 0.4% compared with 9,733 million euro at year-end 2016. Exchange rates had a 168-million euro negative impact, i.e. the equivalent of 1.7% of revenue in 2016. Net acquisitions contributed 51 million euro to 2017 revenue, i.e. the equivalent of 0.5% of 2016 revenue. Growth at constant exchange rates was +1.3%.

Organic growth was +0.8% for the full year of 2017. It includes the impact of the reclassification on a “gross” basis of certain contracts in production and events (see details on page 6). In a difficult context given the numerous challenges facing our clients, Publicis Groupe’s organic growth was penalized by account losses of 2016 and by restructuring at SapientRazorfish. Conversely, it benefited from the growing contribution of accounts won in 2016.

Europe was almost stable at -0.1%. When the impact of acquisitions and exchange rates is factored out; organic growth stood at +1.3%. Mention should be made of the very good momentum in the UK and Italy (respectively +5.5% and +4.0%). France grew by 1.1%. However, Germany recorded negative growth of -6.9% against a very unfavorable comparable period and because of the difficult advertising market. In the second half of 2017, Europe posted negative organic growth of -1.6% after an upswing of +4.3% in the first half-year. This decline was mainly due to the difficulty in outperforming a very strong comparable period (growth exceeded 6% in H2 2016). For this reason, the main countries in the region were down sharply by comparison with June 30, 2017.

North America achieved organic growth of +4.4% in Q4, with growth accelerating after +0.2% and +3.0% in Q2 and Q3 respectively. The USA performed well with +4.5% growth in Q4 following on +3.5% in Q3. This can be attributed to the ramp-up of accounts awarded since the summer of 2016 (including Lowe’s, Synergy Pharmaceuticals, Walmart, USAA) and the impact of further gains since the start of the year (notably Molson Coors and FirstNet). As previously announced, growth was nonetheless affected by the restructuring of SapientRazorfish and the impact on revenue of unprofitable accounts that have been discontinued. Over the full year, organic growth was +0.5% after -0.8% for the first nine months of 2017. Given the weakening of the dollar against the euro, reported revenue was down 0.9% in 2017.

Asia Pacific reported revenue growth of -2.3% (organic growth of -1.5%). China declined by 7.6% due to difficulties encountered by an agency currently undergoing a strategic review for which a full sale agreement was concluded at the end of 2017 (and which will materialize in the first months of 2018). Activity in Singapore grew by 4.4%. India is consolidating with growth of +0.4% in Q1 and +13.0% in Q2, followed by a further +3.9% and +5.2% in Q3 and Q4 2017 respectively.

Latin America rose by +6.6% (+4.8% on an organic basis). In Brazil, revenue was up 4.6% at year-end 2017, after standing at -0.8% at September 30, thanks to the ramp-up of accounts won in early 2017 (Bradesco, Petrobras). In addition, revenue in the first nine months of the year had difficulty outperforming 2016 when Brazil hosted the Olympic Games in Rio. And Mexico continued to post sustained growth with +8.3%.

The Middle East & Africa reported growth of +3.1% (organic growth of +4.4%), driven by strong performance in the United Arab Emirates (+7.7% in 2017).

Anonymous letter

As indicated in the press release issued on January 23, 2018, Publicis Groupe’s auditors and certain financial analysts received an anonymous letter alleging that the Groupe had prematurely applied accounting standard IFRS 15 on revenue recognition in order to artificially boost its organic growth. The author’s intent is clearly to harm Publicis Groupe. The Groupe immediately notified French market authority AMF.

IFRS 15 has become applicable by the Groupe as of January 1, 2018, as it is now a compulsory accounting principle. Accordingly, its revenue will be increased by over 600 million euro, thus raising its 2017 revenue to over 10 billion euro.

For the purpose to answer the questions raised, a detailed and thorough analysis has been carried out on the calculation of organic growth in 2017. This analysis confirmed that our accounts are strictly in compliance with IFRS and that the calculation of published organic growth is consistent with the methods set forth in our Registration Document. These calculations, which have been carried out contract by contract, include some production and events contracts that have been classified under “gross” whereas they had hitherto been stated as “net”. No media or advertising activity is concerned. The table below shows the impact of reclassifying these contracts on a “gross” basis for each quarter of 2017.

The impact is modest and involves only 33 million euro out of revenue totaling 9,690 million euro for the full-year 2017, i.e. a 40-basis point impact on organic growth. The impact on Q4 2017 organic growth would have been an additional 90 basis points above the organic growth when the above-mentioned contracts are reclassified.

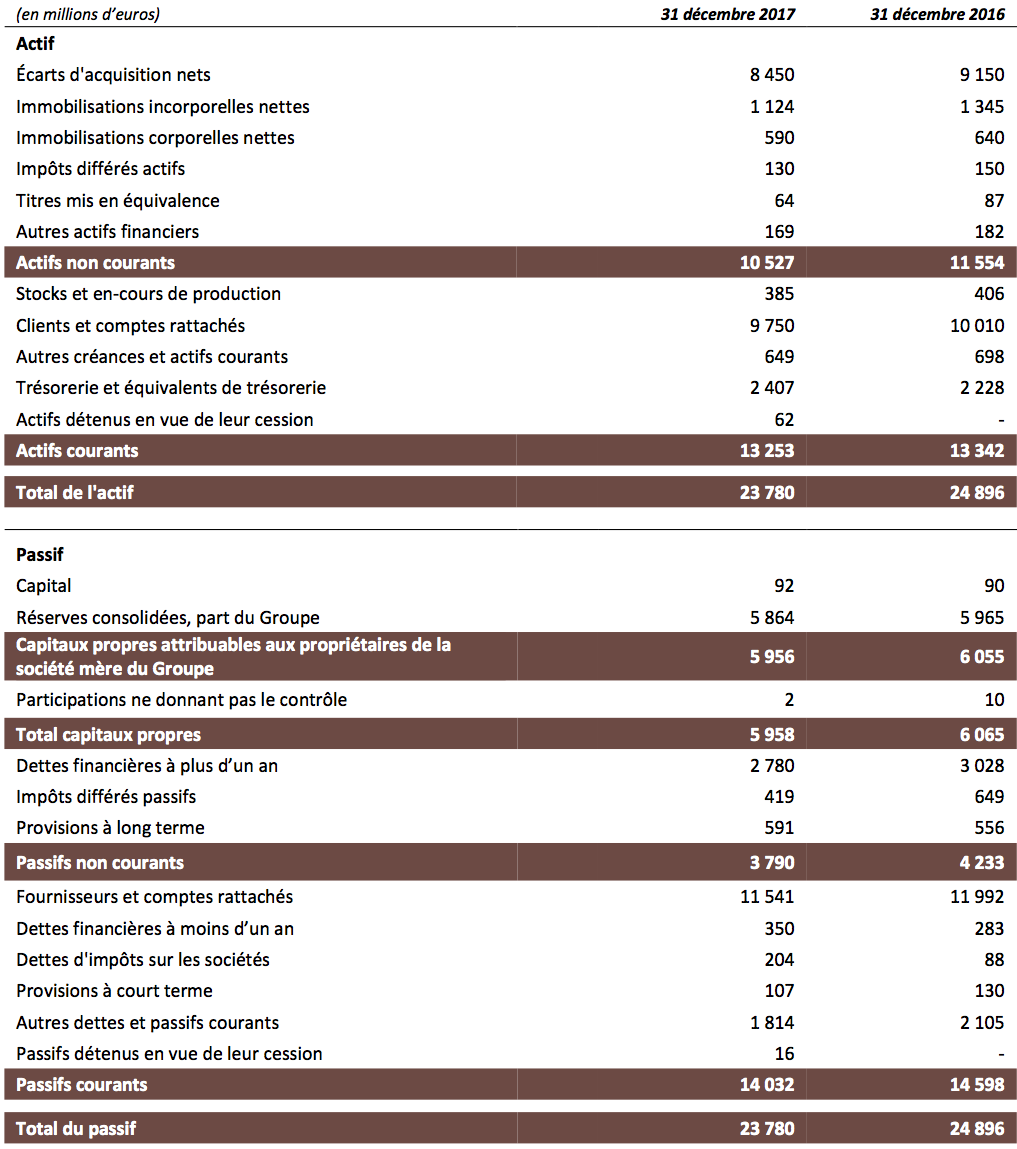

Income statement

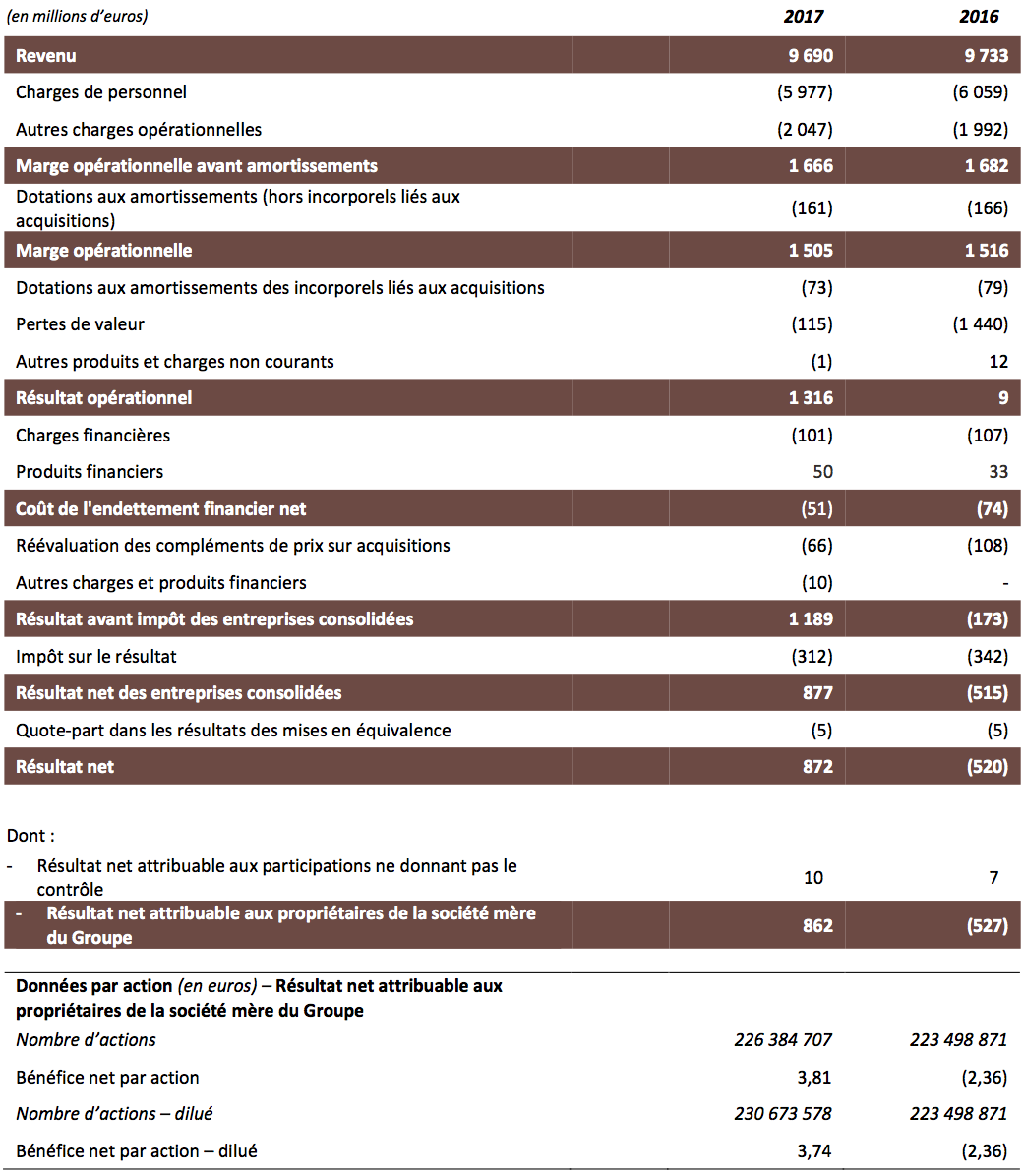

The Operating margin before depreciation and amortization was 1,666 million euro in 2017, down 1.0% from 1,682 million euro in 2016, i.e. a percentage margin before D&A of 17.2% (versus 17.3% in 2016).

Depreciation & Amortization totaled 161 million euro in 2017, slightly below the level of 2016.

The Operating margin amounted to 1,505 million euro, down 0.7% from 1,516 million euro in 2016. It increased by 0.7% at constant exchange rates. The operating margin rate was 15.5%, 10 basis points below 2016 due to the increase in restructuring costs. At constant restructuring costs, the Operating margin and operating margin rate would have increased by 2.4% and 40 basis points respectively .

The operating margins by region were 15.3% for Europe, 16.0% for North America, 14.2% for Asia Pacific, 16.5% for Latin America and 12.2% for the Middle East & Africa .

Amortization of intangibles arising from acquisitions totaled 73 million euro in 2017, compared with 79 million euro in 2016. The Groupe recorded a 115 million euro impairment charge in 2017, mainly concerning Genedigi, one agency in China under disposal, and Proximedia. For the record, impairment charges reached 1,440 million euro in 2016. Other non-recurring income (expenses) netted out to a 1 million euro expense, after income of 12 million euro in 2016.

Operating income amounted to 1,316 million euro in 2017, after 9 million euro in 2016.

Financial income (expense), which is comprised of the cost of net debt plus other financial income and expenses, amounted to an expense of 61 million euro in 2017 (versus an expense of 74 million in 2016). The cost of net debt was 51 million euro in 2017, down from 74 million euro in 2016. Other financial income and expenses netted out to an expense of 10 million euro (0 million euro in 2016).

The revaluation of earn-out payments represented an expense of 66 million euro, after an expense of 108 million in 2016.

Income tax for the period was 312 million euro, down from 342 million euro in 2016. The 2017 tax burden included a net income of 61 million euro as a result of the impact of the US tax reform, which comprised the positive impact of the tax cut on net deferred assets (200 million euro) as well as a toll charge on reserves accumulated by subsidiaries (139 million euro). When this non-recurring element is factored out, the effective rate of tax stood at 27.2% compared with an effective rate of 29.0% in 2016.

The Associates share of profit was a loss of 5 million euro, as in 2016. Minority interests totaled 10 million euro in 2017, after 7 million euro in 2016.

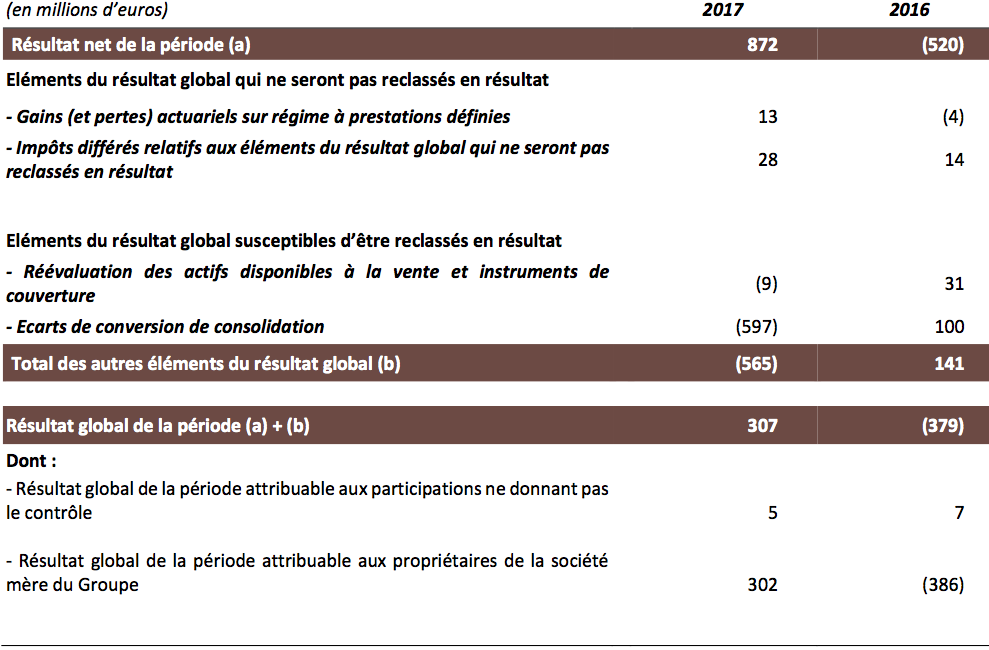

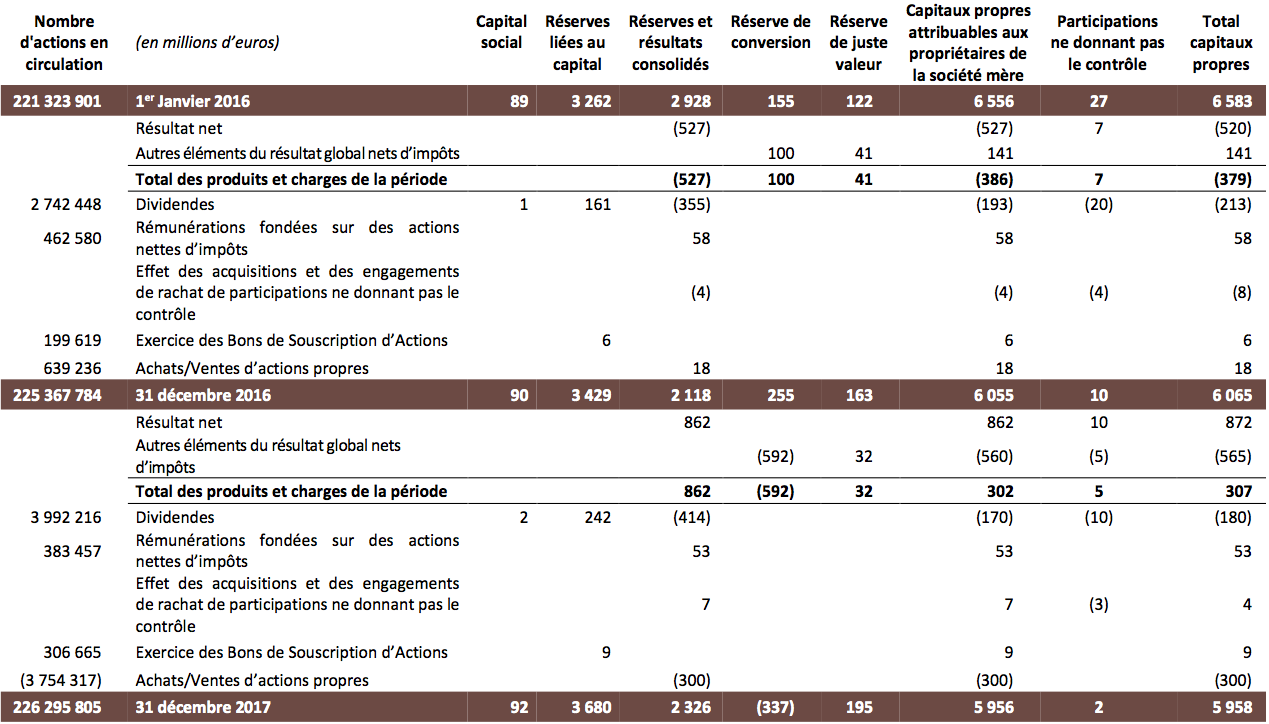

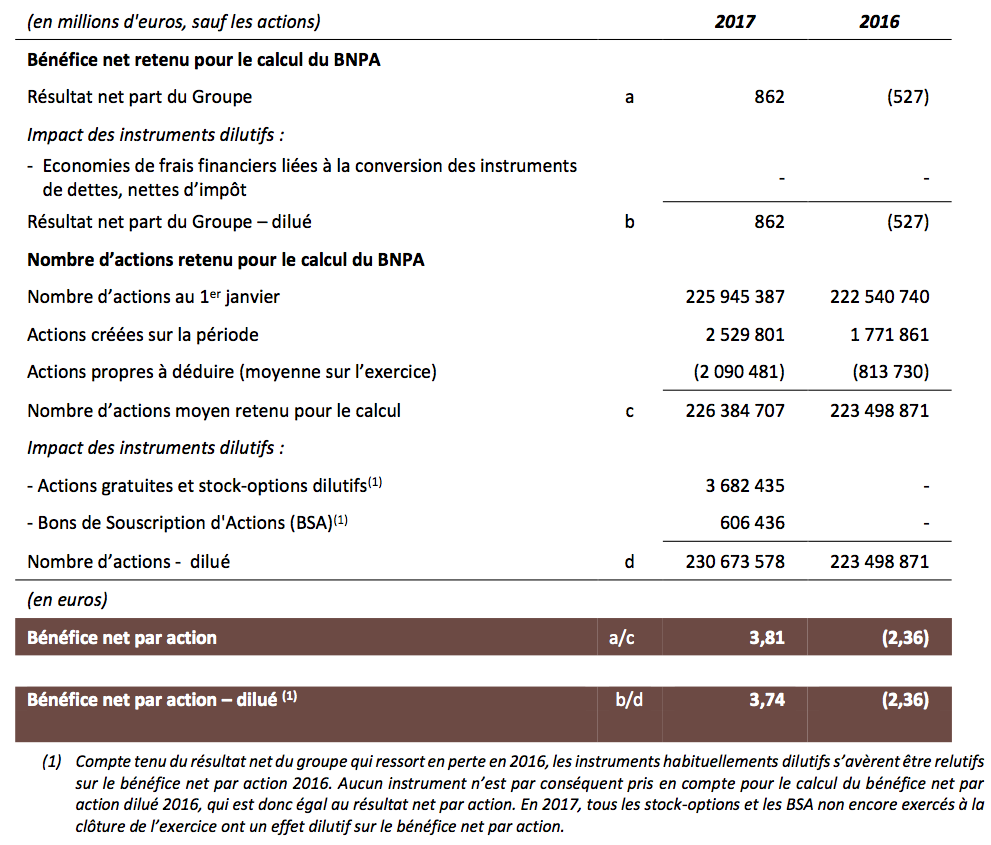

Overall, Net income attributable to the Groupe amounted to 862 million euro at year-end 2017, after a loss of 527 million euro in 2016.

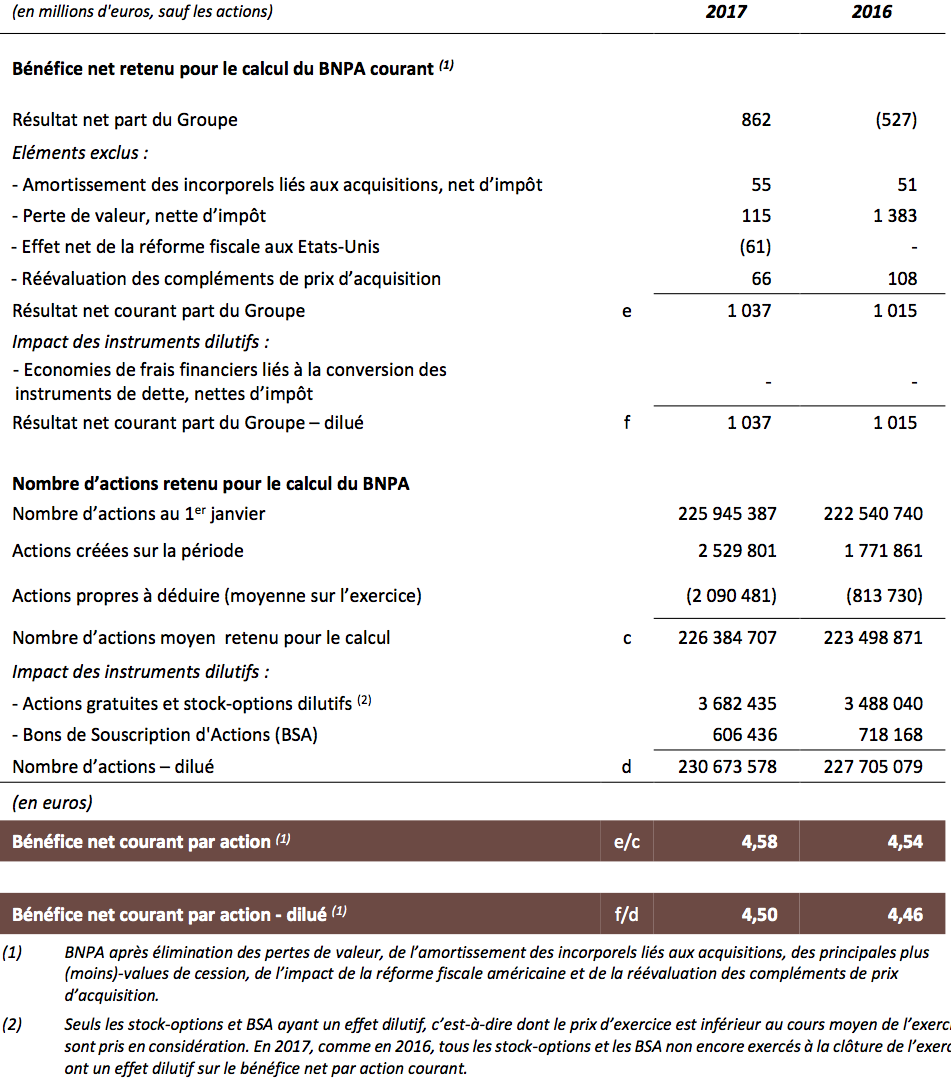

After elimination of impairment charges, amortization of intangibles arising from acquisitions, the main capital gains (or losses) and revaluation of earn-out payments as well as the impact of US tax reform, Headline Group net income stood at 1,037 million euro, i.e. a 2.2% increase .

Headline Earnings Per Share (diluted) rose 0.9% to 4.50 euro.

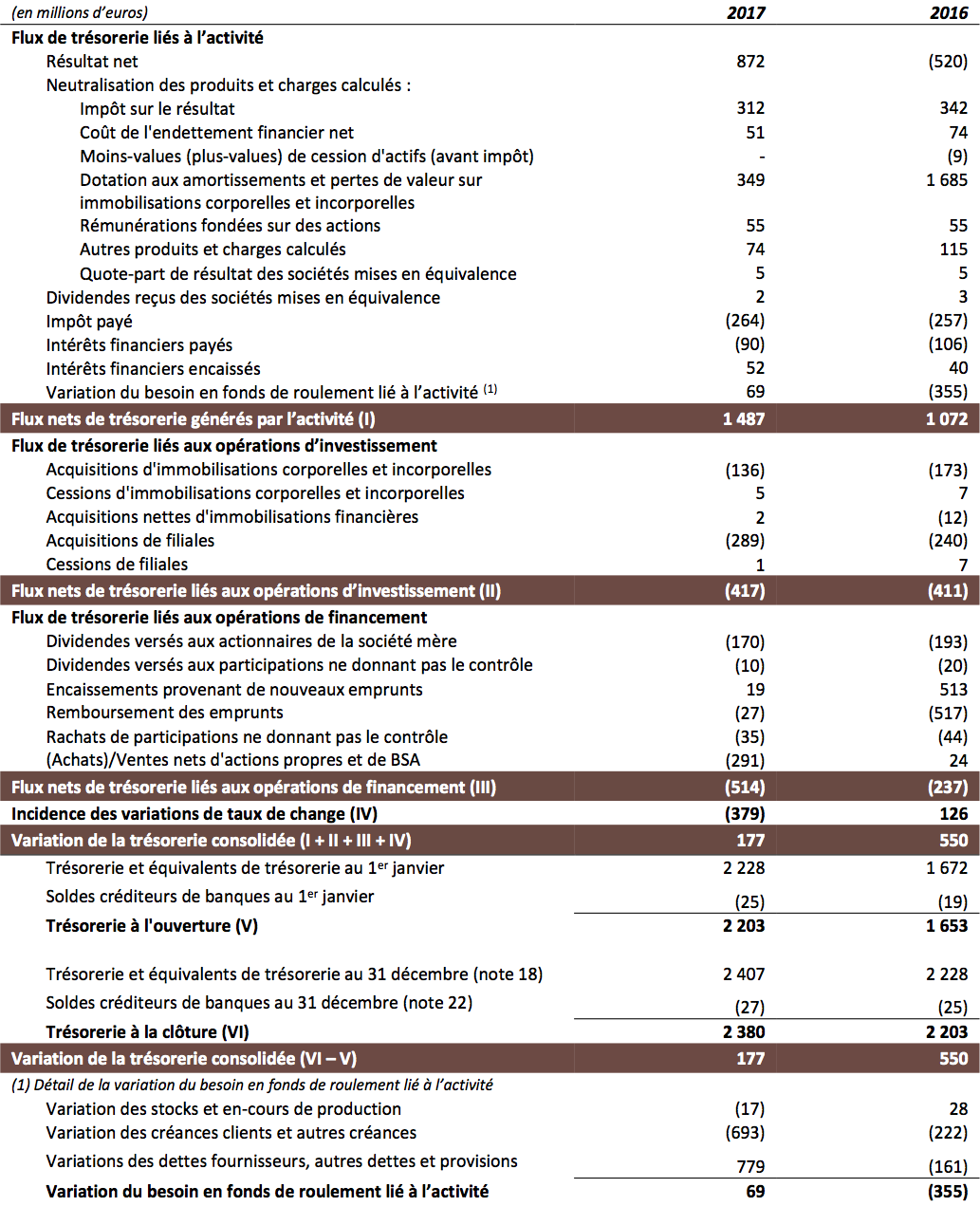

Free Cash Flow

Before changes in working capital requirements, the Groupe’s free cash flow reached 1,287 million euro in 2017, up from 1,261 million euro in 2016. In addition, change in working capital requirements was 69 million euro, improving vs last year.

Net debt

Net debt stood at 727 million euro at December 31, 2017 (i.e. a Debt / Equity ratio of 0.12) after 1,244 million euro at December 31, 2016. The Groupe’s average net debt in 2017 was 1,980 million euro, down from an average of 2,385 million euro in 2016.

Governance and appointments

Since June 1, 2017, Maurice Lévy has been Chairman of the Supervisory Board of which he is also a member. Arthur Sadoun is Chairman of the Management Board (Directoire) which has been reinforced by the arrival of Steve King, CEO of Publicis Media, alongside existing members Jean-Michel Etienne, Executive Vice-President, Chief Financial Officer, and Anne-Gabrielle Heilbronner, Secretary General.

Since August 24 2017, Anne-Gabrielle Heilbronner’s remit has been broadened to include Corporate Social Responsibility (CSR) and the Women’s Forum for Economy and Society. This forum, which is headquartered in Paris and of which Publicis Groupe is majority shareholder, is the world’s leading platform featuring women’s views and voices on major social and economic issues. The Women’s Forum is one facet of Publicis Groupe’s very determined involvement in CSR. True to its values, the Groupe is promoting increasingly demanding standards in the fields of diversity, transparency as regards its practices and personal data protection, with the ambition of delivering innovative solutions that have a positive outcome for society.

Véronique Weill has joined Publicis Groupe as General Manager, in charge of Re:Sources, IT, real estate, insurance and M&A. Before joining Publicis Groupe, Véronique spent 21 years with JPMorgan, mainly in the USA where she was in charge of operations and IT at global level. In 2006, she joined Axa where, as a member of the Management Committee, she focused on operations, technology, digital, marketing and innovation. As Axa’s Chief Operating Officer and subsequently Chief Customer Officer, she helped make Axa one of the world’s leading insurance brands. She reports to Arthur Sadoun and sits on the Groupe’s Executive Committee.

Agathe Bousquet joined the Groupe in September 2017 as President of Publicis Groupe in France. She is responsible for overseeing all of the Groupe’s activities in France, bringing all of our talents to work together and integrating all our expertise in order to reinvent our relationships with our clients and reinforce our positioning as the strategic partner in their own transformation. She started her career in the non-profit sector, then occupied various positions in the Havas Group before chairing Havas Paris. She reports to Arthur Sadoun and sits on the Groupe’s Management Committee.

Emmanuel André joined the Groupe in the newly-created position of Chief Talent Officer (CTO). Based in New York, Emmanuel André is in charge of talent management and recruitment, working directly with the four Solutions’ CEOs and their respective CTOs who report directly to him. He also oversees all Groupe learning, training and development programs. Former International President of TBWA, Emmanuel has a track-record managing HR strategy at a global level, spanning the key areas of learning, career development, top talent recruitment and corporate culture at large. He began his career in advertising in 1993 and has worked for TBWA in Paris, Hong Kong and then New York. He reports directly to Arthur Sadoun and sits on the Groupe’s Management Committee.

Carla Serrano, CEO of Publicis New York and Chief Strategy Officer at Publicis Communications, was promoted to Chief Strategy Officer of Publicis Groupe in June 2017. Throughout her career, Carla has held strategic management positions in large networks and creative agencies. Before joining Publicis, Carla was CEO of Naked NA, CSO of TBWA Chiat/DAY NY, and Chair at Berlin Cameron and Partners.

In June 2017, Publicis Groupe put in place two new management committees, in addition to its Management Board (Directoire). The first is known as the Executive Committee and is in charge of the Groupe’s transformation. It meets every month and is comprised of the following members, in addition to the members of the Management Board:

The second committee, known as the Management Committee, meets every quarter and oversees Groupe operations and execution of its strategy. It is comprised of the Executive Committee members plus the following:

On September 27, 2017, Publicis Groupe announced the forthcoming appointment of Annette King as CEO of Publicis Groupe UK. Annette will report directly to Arthur Sadoun and will sit on the Management Committee. As CEO of Publicis Groupe UK, Annette will oversee all Groupe activities in this market, including those of Publicis Communications, Publicis Media, Publicis.Sapient and Publicis Health. She has been entrusted with implementing the Groupe’s vision of becoming the partner its clients must have for their business transformation. To reach this goal she can count on the support of Steve King who has accepted the role of Executive Sponsor of Publicis Groupe in the UK. Annette will be joining Publicis Groupe after 17 years with Ogilvy Group (WPP Group) where she held eight different positions from Client Lead for American Express in the EMEA region to Managing Director of Ogilvy Interactive, and from New Business Director of OgilvyOne to her most recent position as CEO of Ogilvy Group UK.

On January 22, 2018, the Groupe announced the appointment of Nick Law as Chief Creative Officer of Publicis Groupe and President of Publicis Communications. As one of the industry’s most progressive creative leaders, the choice of Nick Law signals Publicis Groupe’s on-going commitment to creativity and technology at the service of marketing and business transformation. Nick was Global Chief Creative Officer and Vice Chairman of R/GA, the American network belonging to the Interpublic Group and specializing in the convergence of digital, technology and marketing expertise. He will oversee and inspire the entire creative community. As President of Publicis Communications, he will be tasked with developing a unified creative ethos that helps foster strong, dynamic and diverse cultures across the spectrum of the Groupe’s creative brands. Nick Law will start in May 2018 when he will join the Executive Committee and he will report directly to Arthur Sadoun.

External growth and disposals

In January 2017, Publicis Communications acquired two digital agencies via Leo Burnett, namely The Abundancy and Ardent. These agencies will add to Leo Burnett’s arsenal of data, creative and technological capabilities. Ardent provides proprietary technology that uses search data to understand behavior and predict consumer intent, while The Abundancy applies these learnings to inform customer content. Together, these two agencies count 60 professionals who have now joined Leo Burnett under newly appointed CEO Andrew Swinand in the USA.

In July 2017, Publicis Communications acquired Ella Factory, the French consulting agency specializing in corporate communications. Ella Factory was founded in January 2012 and chaired by Clément Léonarduzzi. It has been aligned with Publicis Consultants of which Clément became CEO in October 2017.

Also in July 2017, Publicis Communications announced the acquisition of The Herd Agency, one of Australia’s most important and most awarded agencies. This acquisition enables Publicis Communications to provide its clients with a vast array of PR services including strategy, public affairs, earned media, investor relations, integrated campaigns, crisis communications, social media and marketing content. The Herd Agency has been aligned with MSLGroup in Australia.

Also in July 2017, Prodigious - Publicis Communications’ production platform – announced the acquisition of Translate Plus, a leading global supplier of language services with expertise in “transcreation”. “Transcreation”, which entails completely adapting the brand message of a product or advertisement to a target market, will play an integral part in our global advertising campaigns. Translate Plus was founded in 2008 and now counts 130 employees across ten international offices in London, the Netherlands, Germany, Denmark, Sweden, Italy, Bulgaria, Washington DC, China and Japan. Its client portfolio includes Mondelez, Porsche Consulting, Reckitt Benckiser, Rentalcars and Ricoh.

In September 2017, Publicis Communications announced the acquisition of Harbor Picture Company, a production company specialized in advertising films for television and internet. Created seven years ago, Harbor Picture Company has been aligned with Prodigious, the Groupe’s production entity.

In November 2017, Publicis Health announced the acquisition of the PlowShare Group, the leading communications agency that works exclusively with humanitarian organizations and federal agencies on social issue and cause marketing campaigns. Founded more than 20 years ago, PlowShare works notably with the American Red Cross, Centers for Disease Control and Prevention, Habitat for Humanity, Make-A-Wish Foundation, March of Dimes, and the World Wildlife Fund. Headquartered in Stamford (Connecticut) with satellite offices in Atlanta, New York and Washington DC, PlowShare leverages a team of 18 full-time employees and integrates a network of external partners to provide a wide service footprint in advertising and marketing which includes media buying, creation, PR and social media among others.

Lastly, on December 18, 2017, Publicis Groupe reached a definitive agreement for the sale of 100% of Genedigi in China. As this sale is subject to authorizations to be obtained from the Chinese authorities, the sale should be finalized before the end of the first quarter of 2018.

Finance

On March 13, 2017, Publicis Groupe entered into a share buyback agreement with an Investment Services Provider under the share buyback program authorized by the Shareholders’ meeting of May 25, 2016. The buyback period extended from March 14, 2017 to June 30, 2017.

Upon expiry of the agreement period, 5,000,000 shares had been bought at an average price of 64.69 euro per share (64.89 euro including tax on financial transactions).

Though 2017 was another challenging year for the industry, it highlighted once again the Groupe’s ability to fight on several fronts at the same time, namely to deliver the results expected of it while transforming.

Organic growth improved throughout 2017, as did the operating margin (at constant restructuring costs). The proposed dividend of 2 euro represents an 8.1% increase and is a reflection on the Groupe’s confidence about the future.

The Groupe’s transformation is ongoing and has accelerated, and the new model built by Publicis Groupe demonstrates its attractiveness, shown through the arrival of new talents and new business.

Publicis Groupe’s next event will be the investor day of March 20, 2018 during which growth and margin objectives will be presented and set in the light of the new context of the industry and the Groupe’s own transformation. This event will be the occasion for the Groupe to shed more light on its ambition to become the leader in marketing and business transformation, including the strategy and the means to reach these objectives.

Our industry has been affected by several events over the past few years such as the media palooza, the ANA investigation which undermined trust and confidence in the sector, digital disruption which has caused strong pressures from advertisers, and the deep changes in the way the Groupe operates brought on by technology and data.

To deal with these relational and economic upheavals, the Groupe has undertaken a company-wide restructuring and has strengthened its assets in technology, data and its talents, in order to best position the Groupe for the future. While the objectives set in 2013 need to be revisited, short term trends are encouraging.

Regarding growth, investments are being made to break Publicis Groupe away from the low growth cycle that has characterized the industry during the past years. In 2018 the Groupe should post a higher organic growth than in 2017. Q1 should be positive, with a noticeable upswing from last year’s first quarter at -1.2%.

Regarding margin, efforts to reduce our costs will be sustained. Part of these savings is reinvested to create the conditions of the Groupe’s future solid growth. Overall, on top of these investments, margin should continue to enhance over the coming years, starting in 2018.

Certain information contained in this document, other than historical information, may constitute forward-looking statements or unaudited financial forecasts. These forward-looking statements and forecasts are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These forward-looking statements and forecasts are presented as at the date of this document and, other than as required by applicable law, Publicis Groupe does not assume any obligation to update them to reflect new information or events or for any other reason. Publicis Groupe urges you carefully to consider the risk factors that may affect its business, as set out in the Registration Documents filed with the French Autorité des Marchés Financiers (AMF) and which is available on the website of Publicis Groupe (www.publicisgroupe.com), including an unfavorable economic climate, an extremely competitive market sector, the possibility that our clients could seek to terminate their contracts with us at short notice, the fact that a substantial part of the Group’s revenue is derived from certain key clients, conflicts of interest between advertisers active in the same sector, the Group’s dependence on its directors and employees, laws and regulations which apply to the Group’s business, legal action brought against the Group based on allegations that certain of the Group’s commercials are deceptive or misleading or that the products of certain clients are defective, the strategy of growing through acquisitions, the depreciation of goodwill and assets listed on the Group’s balance sheet, the Group’s presence in emerging markets, exposure to liquidity risk, a drop in the Group’s credit rating and exposure to the risks of financial markets.

Bradesco (Brazil), Petrobras (Brazil), eBay (France), Nokia (South Africa), Uber (Singapore), Singtel (Singapore), Marriott (USA), SNHU (USA), Chromebook (USA), Truecaller (Sweden), Match.com (Meetic) (Pan-Europe), Great West Life (Canada), USAA (USA), AkzoNobel (Global), Culligan Water (USA), Service Civique (France), Sunrise (Switzerland), Britvic (UK), Asics (Global), Anheuser-Busch InBev / Lime-A-Rita (USA), Care.org (USA), Google (UK), Red Bull (Singapore), Queensland Health (Australia), Nordrhein-Westfalen/Startercenter (Germany), Post (Switzerland)

20th Century Fox (Australia), Aldi Stores Limited (Australia), Coty Luxury (Denmark), Ego (Australia), Expedia (Singapore), KFC (USA), Lowe's (USA), Mattel (USA), Merck (EMEA), Molson Coors (USA & UK), NBCF (National Breast Cancer Foundation) (USA), PartyPoker (Norway), Royal Caribbean Cruises (UK), Singapore Tourism (Global), Southern Cross Travel Insurance (Australia), Bel Group (Global), Carpetright (UK), CCU (Compania de las Cervecerias Unidas) (Argentina), Coty Luxury (Norway), Credit Suisse Group (Italy), Danks Hardware (Australia), Dubai Corporation for Tourism & Commerce Marketing (Middle East), Euroloan Consumer Finance (Poland), Fondazione Ania (Italy), Grupa Allegro (Poland), H&R Block (USA), JC Jeans & Clothes (Sweden), Kolonial.no (Norway), Luminous Power Technologies (India), Materialgruppen AB Kimberly-Clark (Sweden), P&G (UK), PayU India (India), Procter & Gamble (UK & Ireland), ZTE Mobile (India), Alibaba (Tmall) (China), AOK-Bundesverband (Germany), Codorniu (Spain), Cubus (Nordics), Cubus (Sweden), Dressmann (Norway), Fondazione Ania (Italy), Godrej & Boyce (India), Lenskart (India), Mattress Firm (USA), Profile Pensions (United Kingdom), R+V Versicherung AG (Germany), Southwest Airlines (USA), Storck (Germany), Telkom (South Africa), AB InBev (Colombia & Peru), Altice Media Group (France), Angel Wealth (India), Arts House (Singapore), Avon (APAC), Bookmyshow (India), BSH (France), Codorniu (Spain), David's Bridal (USA), Didi Chuxing (China), Dressmann (Norway), Ebay (Canada), Fondazione Ania (Italy), HDFC Bank (India), HDFC Ergo (India), Heineken (Poland), ICICI Securities (India), Kaufland Polska (Poland), Kotak General Insurance (India), Kraft Heinz (India), L`Oreal Polska (online) (Poland), Lenskart (India), Lionsgate Entertainment (USA), L'Oreal (Germany & Switzerland), Luckia Gaming Group (Spain), Luxasia (Singapore), Mattress Firm (USA), McDonald's (India), McDonalds (MENA), MCI Whole of Government (Singapore), Ministry of Social and Family Development (Singapore), Montreal Transit Corporation (Canada), MUFG Bank (Singapore), Nestle (India), Nestle (MENA), OSN (MENA), PharmEasy (India), Profile Pensions (UK), Queisser Pharma (Poland), SFR (France), Snooze (Steinhoff / Pepkor) (Australia), TEG Live (Australia), Telemundo (USA), Udacity (India), Vistara (India), Znanylekarz (Poland)

Mattel (USA), Carnival Corporation (USA), FirstNet / AT&T Government Solutions (USA), Lyft (USA), GSK (USA), The Nature Conservancy (USA), Intermarche (France), Oshawa (Canada), W.L. Gore & Associates (Allemagne), British Gas (Royaume-Uni), McDonalds Corporation (USA), McDonalds Deutschland LLC (Allemagne), Roche Foundation (Singapore), Carrefour (Global)

OCBC (Malaysia), Reckitt Beckenzier (Malaysia), 20th Fox Century (Malaysia), Ikea (Czech Republic), BEL (Czech Republic), l’Oréal (Czech Republic), Société Générale (Serbia), P&G (The Nertherlands), FCA (The Nertherlands), Skoda (The Nertherlands), Aldi (Belgium), Informazout (Belgium), ABinBEV (Colombia), Renault (Argentina), SGEBS (Romania), Coca Cola (Romania), Franke (Romania), KBC (Bulgaria), Merck (Czech Republic), Silvano (Czech Republic), VISA (Czech Republic), Kraft/Heinz (Czech Republic), Vileda (Czech Republic), SAB Miller (Czech Republic), Plzensky prazdroj, s.r.o. (Czech Republic), Generali (Czech Republic & Slovakia), Cordblood (Slovakia), Unicef (Serbia), Momondo (Turkey), Yaşar Holding (Turkey), Visa (Turkey), Νestle (Greece), Delacre (Belgium), Recticel (Belgium), ING Sprinters (Netherlands), ASR (Netherlands), JVH Gaming (Netherlands), Charlie Temple (Netherlands), Binck Bank (Netherlands), Nutricia (Netherlands), Expedia (Malaysia), Singapore Tourism Board (Thailand), Inbev (Colombia & Peru), Telefonica (Central America), Inbev (Colombia, Peru), KFC (Thailand), Philip Morris International – IQOS (Japan), SKODA – e commerce (Netherlands), Boehringer Ingelheim Animal Health (Japan), Cencosud (Colombia), Turk Telecom (Turkey), ABInBev (Colombia, Peru, Ecuador), Fiat Chrysler Automobiles (Netherlands), PUIG (Miami, Chile, Argentina, Peru), SCS (Netherlands), General Motors – Chevrolet (Argentina), Philip Morris International – RRP (Korea), Volkswagen (Korea)

Novartis (USA), Genentech (USA), Shire (USA), Adapt (USA), AMAG (USA), Sunovion (USA), Clinigen Group (Global), Purdue (USA), Merck & Co (USA), Intarcia Therapeutics (USA), Flexion Therapeutics (USA), AbbVie (USA), Ipsen (USA), Emmaus Life Sciences (USA), Ultragenyx Pharmaceutical (USA), AcelRx Pharmaceuticals (USA), Merck KGaA (USA), Roche (UK), AstraZeneca (USA), Hospital Corporation of America (USA), Stryker Corporation (USA), Swanson Health Products (USA), Alcon Laboratories (USA), Boehringer Ingelheim (USA), Paratek Pharmaceuticals, Pfizer Inc. (USA), Biogen Inc. (USA), Galderma (Europe)

09-01-2017 - Publicis Communications: Appointment at Leo Burnett USA and two acquisitions in digital

11-01-2017 - Publicis Communications: Appointment at Saatchi & Saatchi; Robert Senior leaves the Groupe

18-01-2017 - Publicis One: Appointment in Japan

19-01-2017 - Publicis One: Appointment in Turkey

26-01-2017 - Governance announcement at Publicis Groupe

01-02-2017 - Publicis Communications: Appointment for the Nordics region

03-02-2017 - Publicis.Sapient: Appointment at DigitasLBi; Luke Taylor leaves the Groupe

09-02-2017 - 2016 annual results

21-02-2017 - Viva Technology: 2nd edition on June 15-17, 2017

13-03-2017 - Share Repurchase Agreement

16-03-2017 - Publicis.Sapient: launch of SapientRazorfish’s integrated offering

22-03-2017 - Partnership between Publicis Groupe and Microsoft in data and artificial intelligence

18-04-2017 - Appointment of Agathe Bousquet as President of the Groupe in France

20-04-2017 - First quarter 2017 revenue

09-05-2017 - Appointment of Céline Fronval as Publicis Groupe’s General Counsel

31-05-2017 - Combined General Shareholders' Meeting

14-06-2017 - Publicis Groupe Boosts Management Structure with Two Senior Nominations and New Governing Bodies

19-06-2017 - Publicis Groupe and Alibaba Announce China Uni Marketing Partnership

20-06-2017 - Publicis Groupe Builds the First Professional Assistant Platform Powered by AI and Machine Learning

20-07-2017 - First half 2017 results

24-07-2017 - Publicis One: Appointment in Panama

04-08-2017 - Acquisition of Translate Plus by Prodigious

21-08-2017 - Appointment of Emmanuel André as Publicis Groupe’s Chief Talent Officer

24-08-2017 - Anne-Gabrielle Heilbronner, member of the Directoire and Groupe Secretary General, takes ESG and the Women’s Forum for Economy and Society under her responsibility

20-09-2017 - The next edition of Viva Technology to be held from on May 24-26, 2018 in Paris

02-10-2017 - Publicis Groupe joins more than 150 Companies to Make Unprecedented Commitment to Advance Diversity & Inclusion in the Workplace

03-10-2017 - Appointment of Clément Léonarduzzi as CEO of Publicis Consultants

19-10-2017 - Third quarter 2017 revenue

02-11-2017 - L’Oréal Group Selects Publicis Media for Consolidated Media Buying in France

18-12-2017 - Publicis Groupe is back with its 2018 Wishes

EBITDA: operating margin before depreciation.

Operating margin: Revenue after personnel costs, other operating expenses (excl. non-current income and expense) and depreciation (excl. amortization of intangibles arising on acquisitions).

Operating margin rate: Operating margin as a percentage of revenue.

Headline Group Net Income: Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals, effect of US tax reform and revaluation of earn-out payments

EPS (Earnings per share): Group net income divided by average number of shares, not diluted.

EPS, diluted (Earnings per share, diluted): Group net income divided by average number of shares, diluted.

Headline EPS, diluted (Headline Earnings per share, diluted): Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals, effect of US tax reform and revaluation of earn-out payments, divided by average number of shares, diluted.

Capex : Net acquisitions of tangible and intangible assets, excluding financial investments and other financial assets.

Free Cash Flow before changes in working capital requirements: Net cash flow from operating activities before changes in WCR linked to operating activities.

Net Debt (or financial net debt): Sum of long and short financial debt and associated derivatives, net of treasury and cash equivalents.

Average net debt: Average of monthly net debt at end of month.

Dividend pay-out: Dividend per share / Headline diluted EPS.

Publicis Groupe [Euronext Paris FR0000130577, CAC 40] is a global leader in communication. The Groupe is positioned at every step of the value chain, from consulting to execution, combining marketing transformation and digital business transformation. Publicis Groupe is a privileged partner in its clients’ transformation to enhance personalization at scale. The Groupe relies on ten expertise concentrated within four main activities: Communication, Media, Data and Technology. Through a unified and fluid organization, its clients have a facilitated access to all its expertise in every market. Present in over 100 countries, Publicis Groupe employs around 101,000 professionals.

Jean-Michel Bonamy

Deputy CFO

jean-michel.bonamy@publicisgroupe.com

+ 33 (0) 1 44 43 74 88

Amy Hadfield

DIRECTOR OF GLOBAL COMMUNICATIONS PUBLICIS GROUPE