Subscribe

Sign up to receive the Publicis Groupe newsletter

No results were found for your search

Subscribe

Sign up to receive the Publicis Groupe newsletter

07/20/2017, Paris

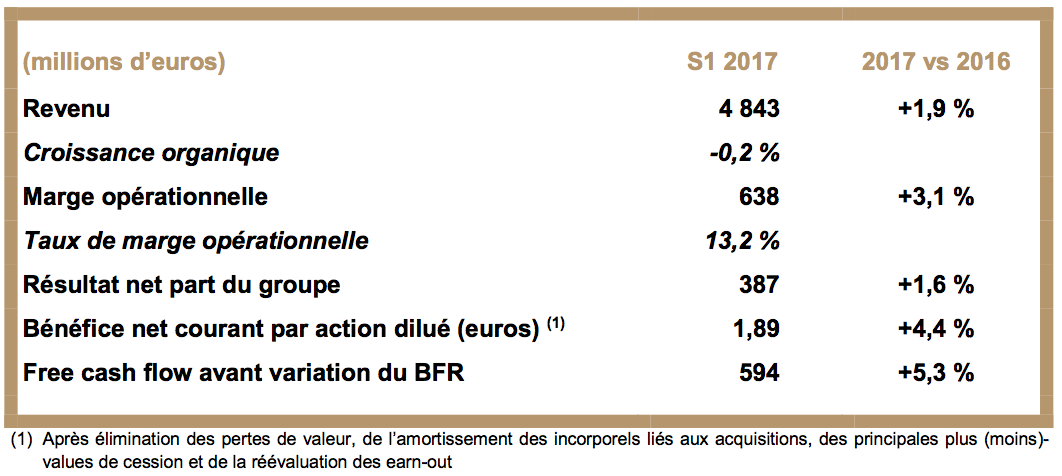

The first half results are encouraging. Organic growth was +0.8% in the second quarter leading to -0.2% in the first half year 2017. Headline group net income was 432 million euros up 6.4%.

Arthur Sadoun, CEO and Chairman of the Management Board:

“Launched 18 months ago, The Power of One has been one of the boldest moves the Groupe has made. Maurice Lévy has been the architect and has designed it. We are now moving to the next stage. The first 6 months of 2017 were particularly dense, as we modified our governance, defined our action plan and brought together the teams responsible for taking The Power of One to new heights. Thanks to our capabilities in consulting, creativity, media and technology, Publicis Groupe is in a unique position to help transform and grow our clients’ businesses, through big ideas.

We have one objective: become the market leader of marketing and business transformation. This means being recognized as the indispensable partner of our clients in their transformation. To achieve this ambition, we need to accelerate in execution and go deeper in integration. We have set 4 priorities for the months to come: make our model a reality for all of our clients, leverage our competitive advantage in technology and consulting, simplify our organizational structures for greater efficiency; design a culture that attracts and retains the best talents.

Improving organic growth is our number one imperative. This is because organic growth is the key metric of the industry, it is the demonstration of our attractiveness in the market, it is the demonstration that we are competitive and that our model is both built on our clients’ needs and sustainable. Organic growth is required to attract and retain the best talent on the market. And obviously it has to come with greater efficiency. This is vital, as we must remain competitive for our clients and invest in our talents.

We have the right strategy. Our first half results are encouraging. Thanks to the good account win momentum over the last 12 months, resulting directly from The Power of One, organic growth exceeded our own expectations in the second quarter at +0.8% with the US returning to positive territory, and margin improved by 20 basis points in a low growth context.

When it comes to the outlook for the year, we expect the sequential improvement in organic growth to continue in third quarter. And we should return to a growth rate comparable with peers in the second half of the year. For the longer term, my goals are clear: accelerate growth and increase efficiency. We are at the beginning of implementing an action plan with our new governing bodies and we will come back in an articulate and concrete way in the coming months.”

Publicis Groupe’s Supervisory Board met on July 19, 2017, under the chairmanship of Maurice Lévy, to examine the half-yearly accounts at June 30, 2017, presented by Arthur Sadoun, Chairman of the Management Board and Chief Executive Officer.

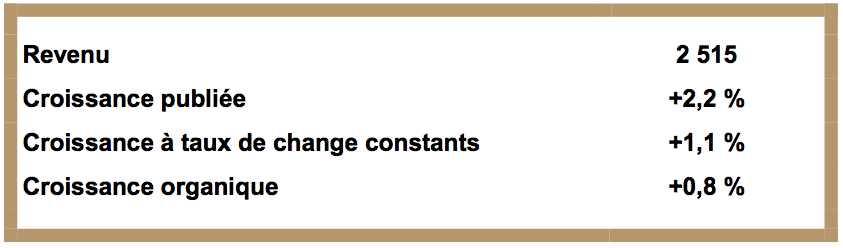

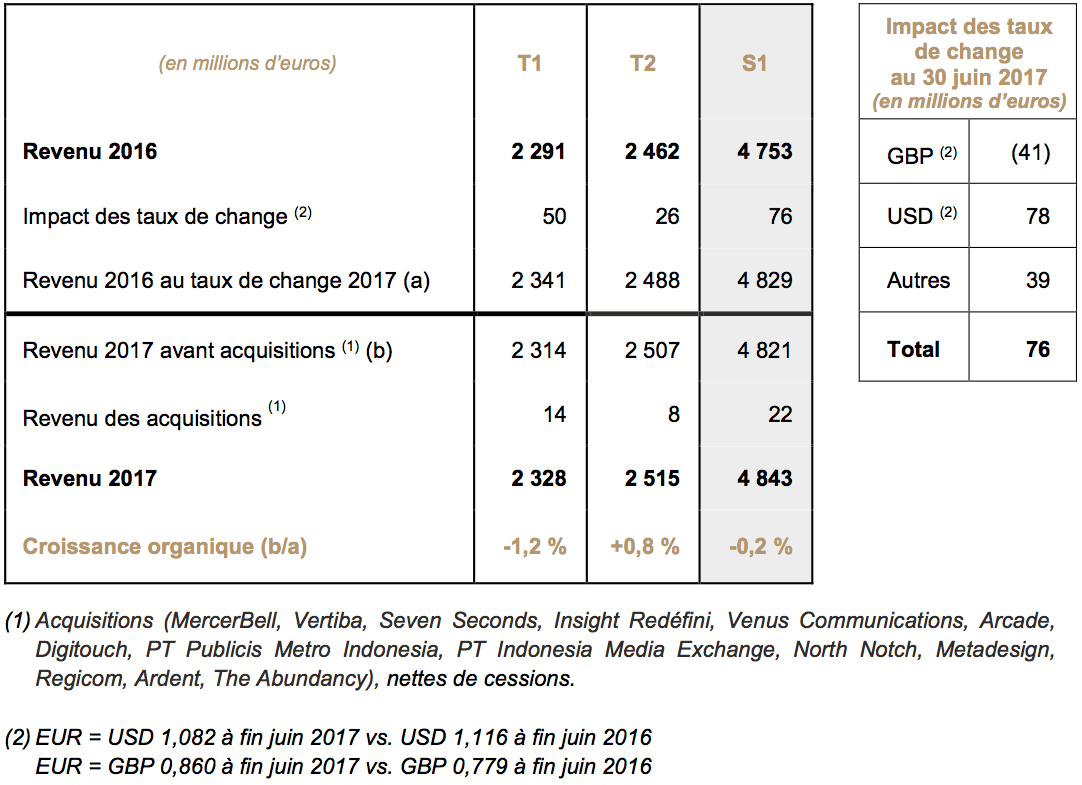

Publicis Groupe’s consolidated revenue for the second quarter of 2017 was 2,515 million euro, up 2.2% from 2,462 million euro in Q2 2016. Exchange rates had a 26-million euro positive impact, i.e. 1.1% of revenue in Q2 2016. Net acquisitions contributed 8 million euro in Q2 2017, i.e. 0.3% of the revenue reported in Q2 2016. Growth at constant exchange rates was +1.1%.

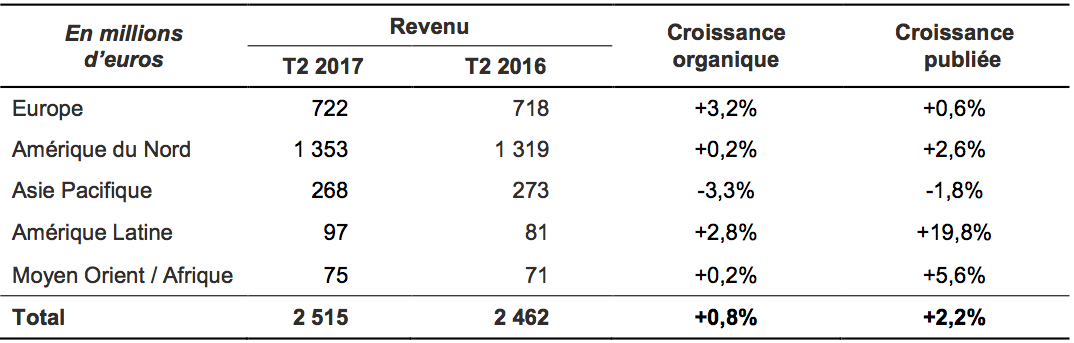

Organic growth was +0.8% in Q2, a slight improvement on the -1.2% organic growth recorded in Q1 thanks to the lesser impact of residual difficulties and the good performance registered in North America. In Q2 2017, while organic growth continued to be hampered by the weak FMCG sector, it benefited nonetheless from the growing contributions of account wins since Q2 2016 (particularly Walmart, HPE, USAA, Asda, Motorola and Lowe’s).

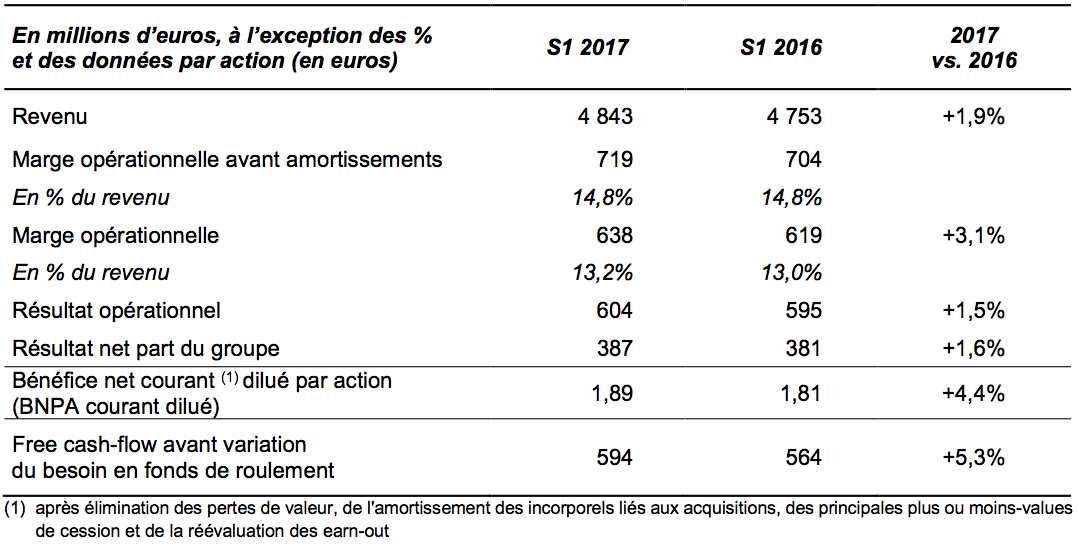

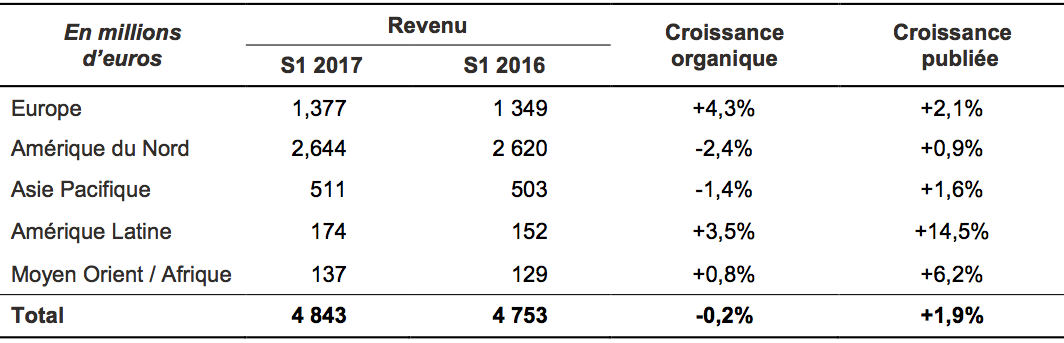

For the first half-year, Publicis Groupe’s consolidated revenue amounted to 4,843 million euro, up 1.9% from 4,753 million for the corresponding period in 2016. Exchange rates had a 76-million euro positive impact, i.e. the equivalent of 1.6% of revenue in H1 2016. Net acquisitions contributed 22 million euro to revenue in H1 2017, i.e. 0.5% of revenue in H1 2016. Growth at constant exchange rates was +0.3%.

Organic growth was -0.2% in the first half year 2017, bearing in mind that the impact of previous difficulties was around 300 basis points.

Europe grew by 2.1%. When the impact of acquisitions and exchange rates is factored out, organic growth was +4.3%. France performed well at +6.2%, while the UK and Italy posted strong momentum at +7.8% and +10.5% respectively. Germany recorded negative growth of -2.1% against a very difficult comparable basis.

Organic growth in North America was back in positive territory in the second quarter (+0.2%) due to the ramp-up of accounts awarded since the summer of 2016. For the first six months of 2017, organic growth remained negative at -2.4% as a result of past issues and at a time when more recent accounts have yet to build up to cruising speed. Revenue was up 0.9% on a reported basis.

Asia Pacific reported positive growth of +1.6% despite organic growth of -1.4%. China fell 6.9% as a result of difficulties encountered by certain entities. Singapore was up 6.2% while business is consolidating in India (+0.4% in Q1 followed by +6.4% in Q2).

Latin America reported +14.5% and organic growth of +3.5%. Brazil improved by 1.0% and Mexico continued its strong growth trend at +14.7%.

The Middle East & Africa region reported +6.2% and organic growth of 0.8%.

Income statement

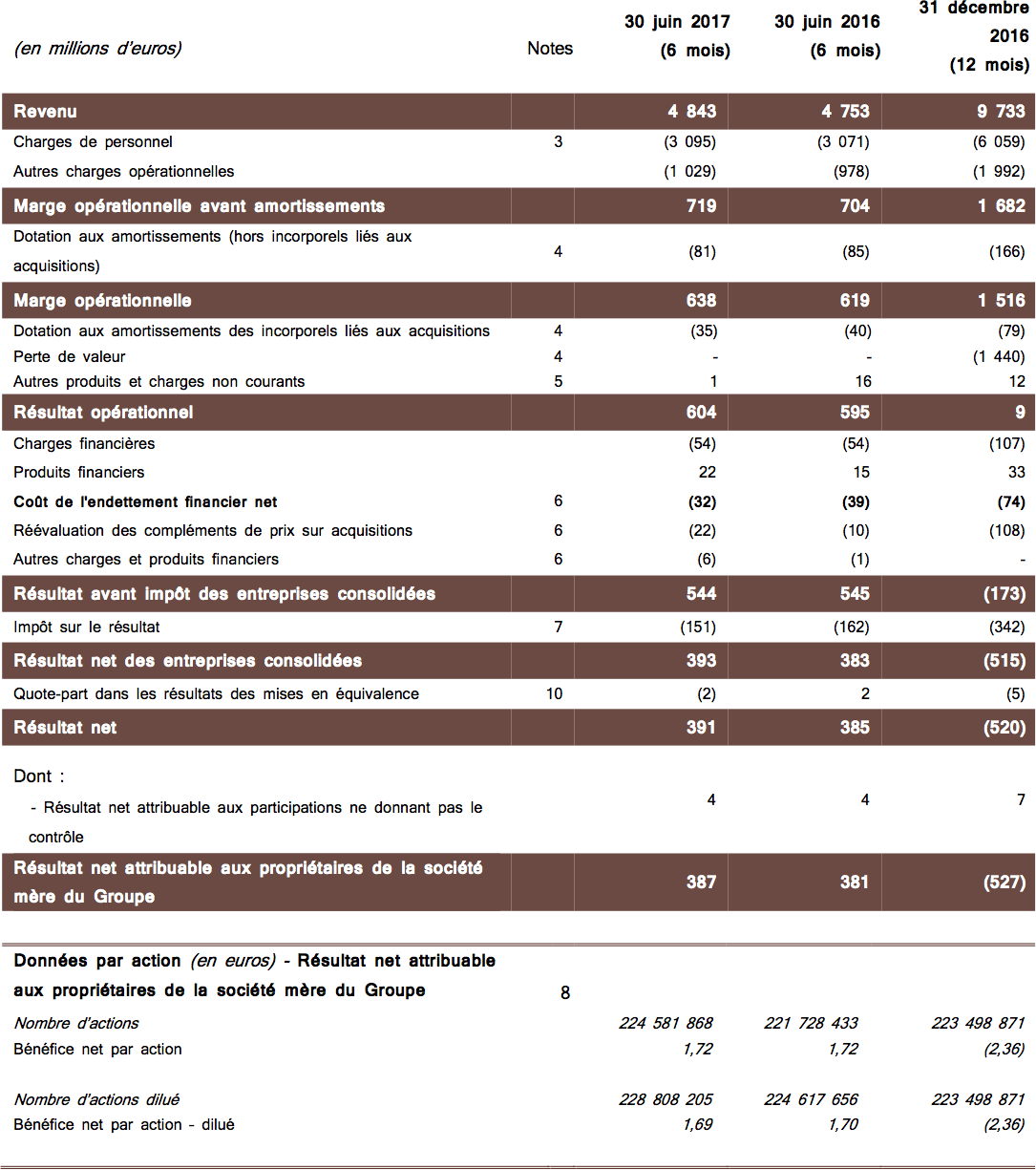

The Operating margin before depreciation and amortization was 719 million euro at June 30, 2017, up 2.1% from 704 million euro in 2016, i.e. a percentage margin of 14.8% of revenue, unchanged from the first half of 2016.

Depreciation & amortization for the first half-year was 81 million euro, down slightly from 85 million in H1 2016.

The Operating margin rose 3.1% to 638 million euro, i.e. a percentage operating margin of 13.2% (up 20 basis points on 2016). This improvement was achieved by cost savings thanks to the implementation of Power of One which were partly offset by investments in new contracts, new IT projects and higher other operating expenses.

The operating margin by region was 13.7% in Europe, 14.1% in North America, 11.9% in Asia Pacific, 5.7% in Latin America and 4.4% in the Middle East & Africa region.

Amortization of intangibles arising from acquisitions totaled 35 million euro at June 30, 2017, after 40 million euro for the corresponding period in 2016. Other non-recurring income (expenses) for the period amounted to income of 1 million euro, compared with income of 16 million euro in H1 2016.

Operating income totaled 604 million euro in H1 2017, up 1.5% from 595 million euro in H1 2016.

Financial income (expense) – not including the revaluation of earn-out costs – amounted to an expense of 38 million euro over the first six months of 2017, after an expense of 40 million euro for the corresponding period in 2016. The cost of net debt was 32 million euro at June 30, 2017, down slightly from 39 million euro in 2016. Other financial income and expenses amounted to a net expense of 6 million euro in the first half of 2017, compared with a net expense of 1 million euro in 2016.

The revaluation of earn-out costs was an expense of 22 million euro (versus 10 million in 2016).

Income tax in H1 2017 was 151 million euro (i.e. an effective tax rate of 27.8%), after 162 million euro in H1 2016 (i.e. an effective tax rate of 29.7%). Over the full year 2016, the effective tax rate was 29.0%.

The Associates’ share of profit was a negative 2 million euro in H1 2017, compared with a positive 2 million in 2016. Minority interests totaled 4 million euro at June 30, 2017, i.e. at the same level as in H1 2016.

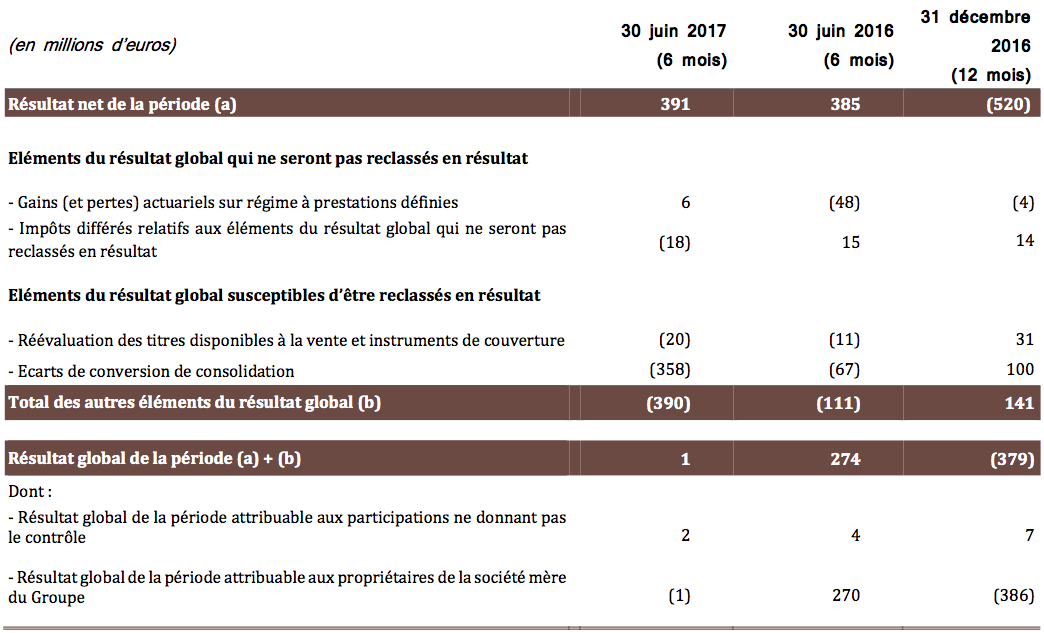

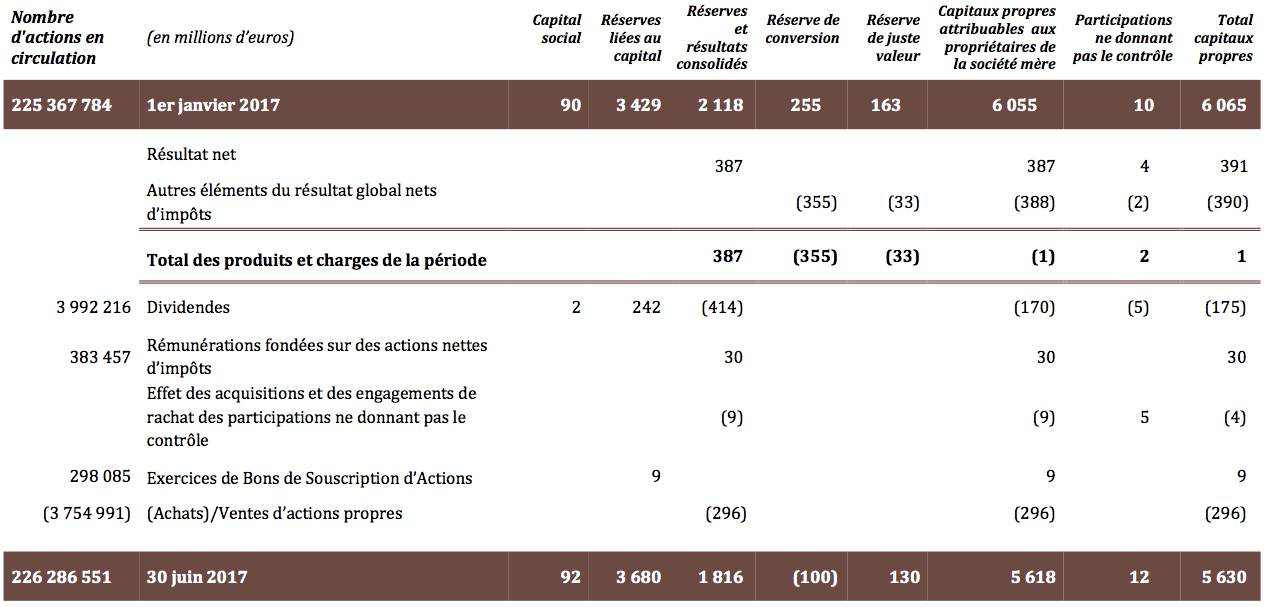

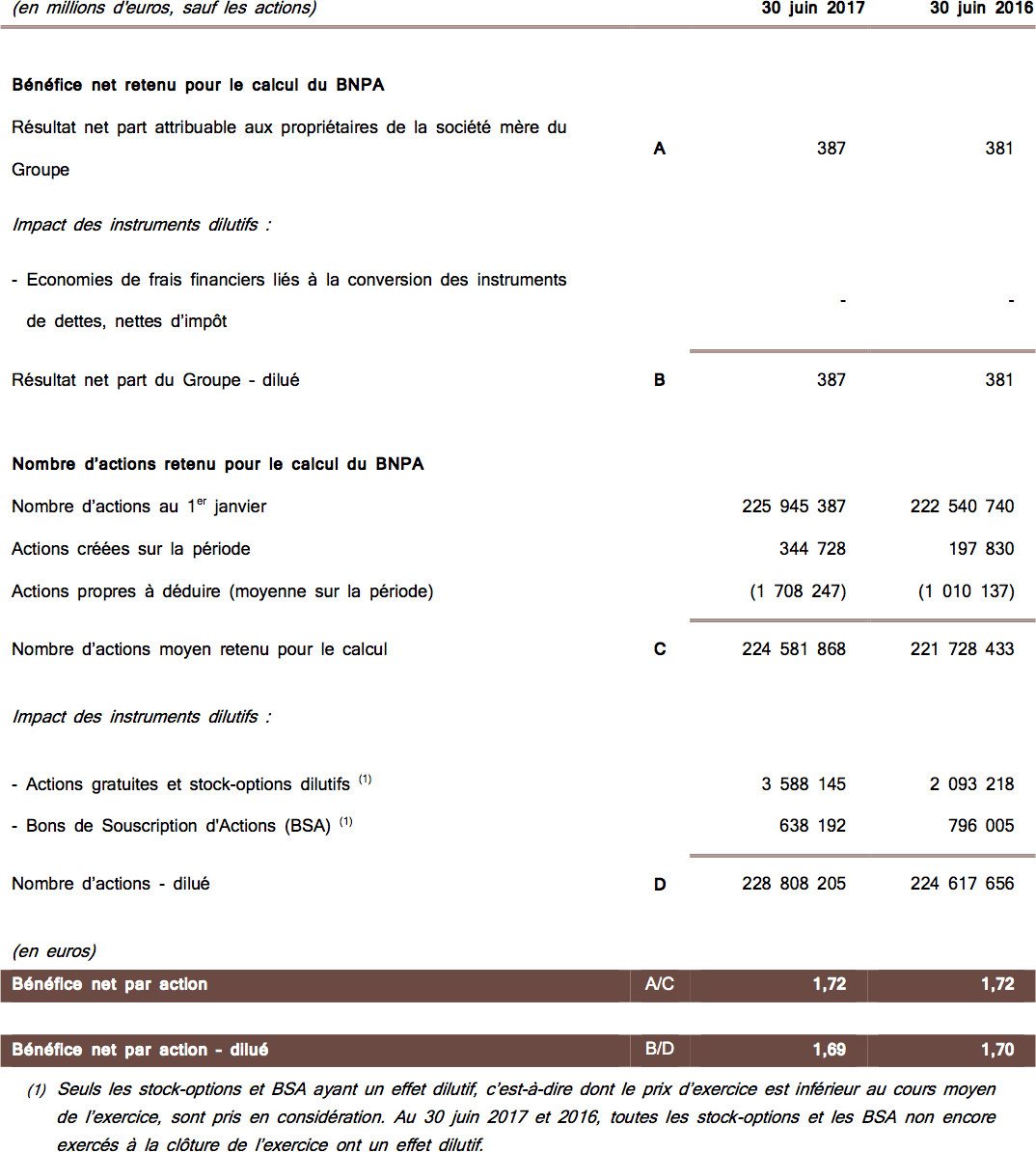

Overall, Net income attributable to the Groupe amounted to 387 million euro at June 30, 2017, after 381 million euro at June 30, 2016.

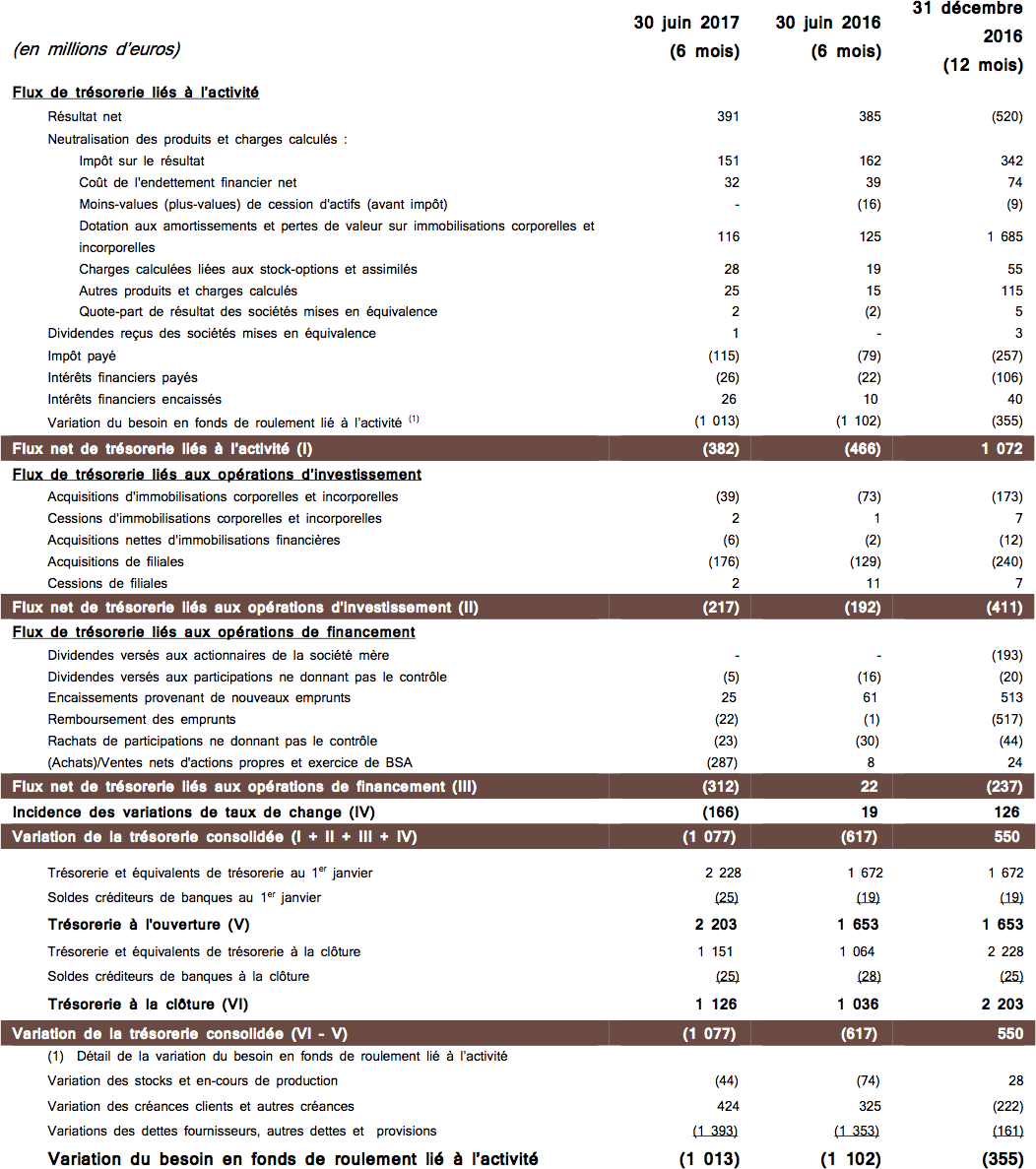

Free cash flow

The Groupe’s free cash flow before working capital requirements increased by 5.3% by comparison with the previous year to reach 594 million euro for the first half of 2017.

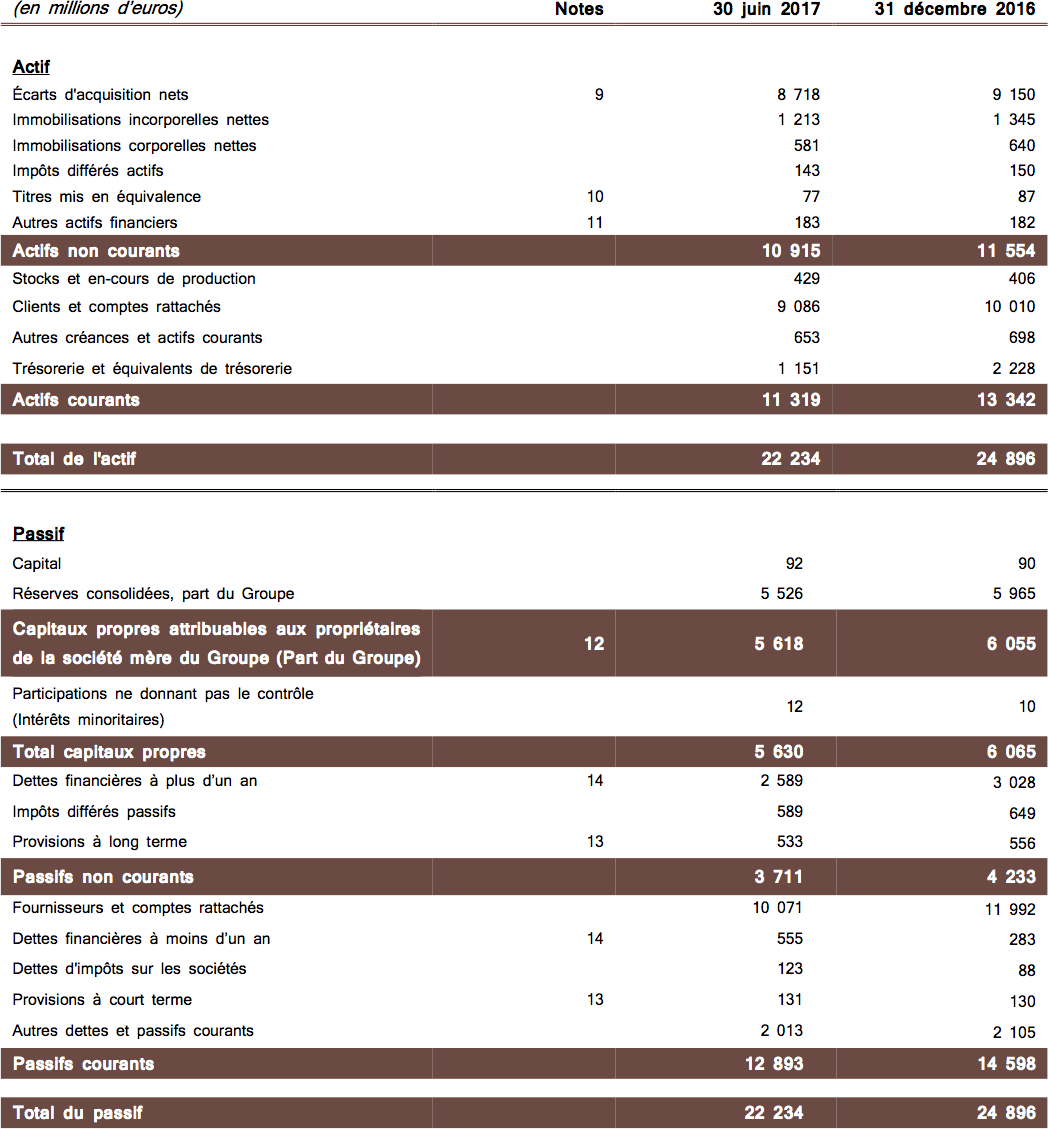

Net debt

Net debt totaled 2,092 million euro at June 30, 2017 (i.e. a debt / equity ratio of 0.37), after 1,244 million euro at year-end 2016 (when the gearing ratio was 0.21). At June 30, 2016, the gearing ratio was 0.38. The Groupe’s average net debt for the first half-year was 1,993 million euro, compared with an average of 2,380 million euro in H1 2016.

Governance and appointments

Since June 1, 2017, Arthur Sadoun has been CEO and Chairman of a Management Board reinforced by the arrival of Steve King, the current CEO of Publicis Media, who has teamed up with Jean-Michel Etienne, Executive Vice-President, Group Chief Financial Officer, and Anne-Gabrielle Heilbronner, Secretary General.

Véronique Weill has been appointed General Manager of Publicis Groupe. She will take on her position as of September 1, 2017 and will be in charge of Re:Sources, IT, real estate, insurance and M&A. Véronique spent 21 years with J.P. Morgan, mainly in the USA, where she was in charge of operations and IT at global level. She then joined Axa in 2006, where, as a member of the Management Committee, she focused on operations, technology, digital, marketing and innovation. As Axa’s Chief Operating Officer and then Chief Customer Officer, she helped make Axa one of the world’s leading insurance brands.

Carla Serrano, CEO of Publicis New York and Chief Strategy Officer at Publicis Communications, has been promoted to Chief Strategy Officer at Publicis Groupe. Throughout her career, Carla has held strategic management positions in large networks and creative agencies. Before joining Publicis, Carla Serrano was CEO of Naked NA, CSO of TBWA Chiat/DAY NY and Chair at Berlin Cameron and Partners.

Publicis Groupe announced the creation of two new management committees in addition to its Management Board (Directoire).

The first is known as the Executive Committee and is responsible for the Groupe’s transformation. It will meet every month and is comprised of the following members, in addition to the members of the Management Board:

The second committee, the Management Committee, will meet every quarter and will oversee Groupe operations and execution of its strategy. It is comprised of the Executive Committee members plus the following:

As submitted by the Supervisory Board, Maurice Lévy has become a member of the Supervisory Board which he now chairs. This proposal was approved by the shareholders at the Shareholders’ meeting of May 31, 2017.

External growth

In January 2017, Publicis Communications acquired two digital agencies, namely The Abundancy and Ardent. These agencies will add to Leo Burnett’s arsenal of data, creative and technological capabilities. Ardent provides proprietary technology that uses search data to understand behavior and predict consumer intent, while The Abundancy applies these learnings to inform custom content. Together, these two agencies count 60 professionals who have now joined Leo Burnett under newly appointed CEO Andrew Swinand in the USA.

Finance

On March 13, 2017, Publicis Groupe entered into a share buyback agreement with an Investment Services Provider under the share buyback program authorized by the Shareholders’ meeting of May 25, 2016. The buyback period extended from March 14 to June 30, 2017.

This agreement was capped at 5,000,000 shares at an average price not exceeding the limits set by the Shareholders’ meeting of May 25, 2016. Shares purchased on the last two days in June were only settled and delivered at the start of July, pursuant to stock market regulations. On June 30, 2017, the 4,878,002 treasury shares effectively delivered, and bought within this agreement for a consideration of 316 million euro, had been purchased at an average of 64.66 euro per share (64.86 euro including tax on financial transactions).

The early part of 2017 has shown encouraging signs. Publicis Groupe returned to positive growth in the second quarter and the operating margin has been improved despite the backdrop of weak growth. The momentum of accounts won has been good, including some prestigious wins such as HSBC, Bel and McDonald’s.

The Groupe’s top priority is to improve its organic growth and there are quite a number of projects still on-going. Our ambition is to post higher growth than our competitors by becoming the leader in marketing and operational transformation. Four concrete measures have been taken for this purpose: make our model a reality for all of our clients, leverage our competitive advantage in technology and consulting, simplify our organizational structures for greater efficiency; design a culture that attracts and retains the best talents.

We expect the sequential improvement in organic growth to continue in Q3. And we should return to a growth rate comparable with peers in the second half of the year. For the longer term, goals are identified: accelerate growth and increase efficiency. The Groupe is at the beginning of implementing an action plan with new governing bodies. A concrete and articulate update will be provided in the coming months.

Certain information contained in this document, other than historical information, may constitute forward-looking statements or unaudited financial forecasts. These forward-looking statements and forecasts are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These forward-looking statements and forecasts are presented as at the date of this document and, other than as required by applicable law, Publicis Groupe does not assume any obligation to update them to reflect new information or events or for any other reason. Publicis Groupe urges you carefully to consider the risk factors that may affect its business, as set out in the Registration Documents filed with the French Autorité des Marchés Financiers (AMF) and which is available on the website of Publicis Groupe (www.publicisgroupe.com), including an unfavorable economic climate, an extremely competitive market sector, the possibility that our clients could seek to terminate their contracts with us at short notice, the fact that a substantial part of the Group’s revenue is derived from certain key clients, conflicts of interest between advertisers active in the same sector, the Group’s dependence on its directors and employees, laws and regulations which apply to the Group’s business, legal action brought against the Group based on allegations that certain of the Group’s commercials are deceptive or misleading or that the products of certain clients are defective, the strategy of growing through acquisitions, the depreciation of goodwill and assets listed on the Group’s balance sheet, the Group’s presence in emerging markets, exposure to liquidity risk, a drop in the Group’s credit rating and exposure to the risks of financial markets.

Bradesco (Brazil), Petrobras (Brazil), eBay (France), Nokia (South Africa), Uber (Singapore), Singtel (Singapore), Marriott (USA), SNHU (USA), Chromebook (USA), Truecaller (Sweden), Match.com (Meetic) (Pan-Europe), Great West Life (Canada), USAA (USA), AkzoNobel (Global), Culligan (water filtration/conditioning systems) (USA)

20th Century Fox (Australia), Aldi Stores Limited (Australia), Coty Luxury (Denmark), Ego (Australia), Expedia (Singapore), KFC (USA), Lowe's (USA), Mattel (USA), Merck (EMEA), Molson Coors (USA & UK), NBCF (National Breast Cancer Foundation) (USA), PartyPoker (Norway), Royal Caribbean Cruises (UK), Singapore Tourism (Global), Southern Cross Travel Insurance (Australia), Bel Group (Global), Carpetright (UK), CCU (Compania de las Cervecerias Unidas) (Argentina), Coty Luxury (Norway), Credit Suisse Group (Italy), Danks Hardware (Australia), Dubai Corporation for Tourism & Commerce Marketing (Middle East), Euroloan Consumer Finance (Poland), Fondazione Ania (Italy), Grupa Allegro (Poland), H&R Block (USA), JC Jeans & Clothes (Sweden), Kolonial.no (Norway), Luminous Power Technologies (India), Materialgruppen AB Kimberly-Clark (Sweden), P&G (UK), PayU India (India), Procter & Gamble (UK & Ireland), ZTE Mobile (India)

Mattel (USA), Carnival Corporation (USA), FirstNet / AT&T Government Solutions (USA), Lyft (USA), GSK (USA), The Nature Conservancy (USA), Intermarche (France)

OCBC (Malaysia), Reckitt Beckenzier (Malaysia), 20th Fox Century (Malaysia), Ikea (Czech Republic), BEL (Czech Republic), l’Oréal (Czech Republic), Société Générale (Serbia), P&G (The Nertherlands), FCA (The Nertherlands), Skoda (The Nertherlands), Aldi (Belgium), Informazout (Belgium), ABinBEV (Colombia), Renault (Argentina)

Novartis (USA), Genentech (USA), Shire (USA), Adapt (USA), AMAG (USA), Sunovion (USA), Clinigen Group (Global), Purdue (USA), Merck & Co (USA), Intarcia Therapeutics (USA), Flexion Therapeutics (USA), AbbVie (USA), Ipsen (USA)

09-01-2017 Publicis Communications: Appointment at Leo Burnett USA and two acquisitions in digital

11-01-2017 Publicis Communications: Appointment at Saatchi & Saatchi; Robert Senior leaves the Groupe

18-01-2017 Publicis One: Appointment in Japan

19-01-2017 Publicis One: Appointment in Turkey

26-01-2017 Governance announcement at Publicis Groupe

01-02-2017 Publicis Communications: Appointment for the Nordics region

03-02-2017 Publicis.Sapient: Appointment at DigitasLBi; Luke Taylor leaves the Groupe

07-02-2017 Appointment of Laurent Carozzi as Publicis Groupe’s Chief Performance Officer

09-02-2017 2016 annual results

21-02-2017 Viva Technology: 2nd edition on June 15-17, 2017

13-03-2017 Share Repurchase Agreement

16-03-2017 Publicis.Sapient: launch of SapientRazorfish’s integrated offering

22-03-2017 Partnership between Publicis Groupe and Microsoft

18-04-2017 Appointment of Agathe Bousquet as President of the Groupe in France

20-04-2017 Q1 2017 Revenue

09-05-2017 Publicis Groupe announces the appointment of Céline Fronval as Groupe General Counsel

31-05-2017 Combined General Shareholders' Meeting

14-06-2017 Publicis Groupe Boosts Management Structure with Two Senior Nominations and New Governing Bodies

19-06-2017 Publicis Groupe and Alibaba Announce China Uni Marketing Partnership

20-06-2017 Publicis Groupe Builds the First Professional Assistant Platform Powered by AI and Machine Learning

EBITDA: operating margin before depreciation.

Operating margin: Revenue after personnel costs, other operating expenses (excl. non-current income and expense) and depreciation (excl. amortization of intangibles arising on acquisitions).

Operating margin rate: Operating margin as a percentage of revenue.

Headline Group Net Income: Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals and revaluation of earn-out payments.

EPS (Earnings per share): Group net income divided by average number of shares, not diluted.

EPS, diluted (Earnings per share, diluted): Group net income divided by average number of shares, diluted.

Headline EPS, diluted (Headline Earnings per share, diluted): Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals and revaluation of earn-out payments, divided by average number of shares, diluted.

Capex : Net acquisitions of tangible and intangible assets, excluding financial investments and other financial assets.

ROCE (Return On Capital Employed): Operating Margin after Tax (using Effective Tax Rate) / Average employed capital. Capital employed include Saatchi & Saatchi goodwill which is not recognised in consolidated accounts under IFRS.

Free Cash Flow before changes in working capital requirements: Net cash flow from operating activities before changes in WCR linked to operating activities.

Net Debt (or financial net debt): Sum of long and short financial debt and associated derivatives, net of treasury and cash equivalents.

Average net debt: Average of monthly net debt at end of month.

Dividend pay-out: Dividend per share / Headline diluted EPS.

Publicis Groupe [Euronext Paris FR0000130577, CAC 40] is a global leader in communication. The Groupe is positioned at every step of the value chain, from consulting to execution, combining marketing transformation and digital business transformation. Publicis Groupe is a privileged partner in its clients’ transformation to enhance personalization at scale. The Groupe relies on ten expertise concentrated within four main activities: Communication, Media, Data and Technology. Through a unified and fluid organization, its clients have a facilitated access to all its expertise in every market. Present in over 100 countries, Publicis Groupe employs around 114,000 professionals.

Jean-Michel Bonamy

Deputy CFO

Amy Hadfield

DIRECTOR OF GLOBAL COMMUNICATIONS