Subscribe

Sign up to receive the Publicis Groupe newsletter

No results were found for your search

Subscribe

Sign up to receive the Publicis Groupe newsletter

10/19/2017, Paris

Sequential improvement of organic growth in Q3 vs Q2 at +1.2%.

Arthur Sadoun, CEO and Chairman of the Management Board:

“We committed to delivering sequential improvement of organic growth in Q3 vs Q2. This has been the case even after a slightly better than expected Q2. Our organic growth reached +1.2% in Q3, after -1.2% in Q1 and +0.8% in Q2,. This is an encouraging sign in a challenging environment. We have seen a good performance in North America at +3.0% reflecting the last 12 months' account wins. Europe showed a slight 1.5% decline, facing a tough comp at +7.6% in Q3 2016.

Q3 also witnessed some positive momentum, both through new business and talents joining the Groupe. This is a clear demonstration of our attractiveness and of the ability of our new model to win on every front and convincing some of the most recognized leaders that Publicis Groupe is building the future.

Over the course of the summer the financial markets were exposed to a negative news flow regarding our industry. But the truth is that there is nothing new there. We all know that our industry is facing many challenges. Consumer behavior is changing, the media landscape is being disrupted, we are confronted with new competition and our clients have been facing challenges around growth, cost and brand trust challenges for years.

At Publicis Groupe, we decided that to rest on our laurels was not an option and we committed to transform for the better in an ambitious and consistent way.

With the acquisition of Sapient, we have put technology at the core of the business transformation of our clients. With The Power of One, we have broken down the silos, allowing us to offer a unique end-to-end solution with consulting, technology, creative, media, digital and obviously data at the core, seamlessly. For the last 4 months, we have been accelerating the execution of our plan by shifting our model from a communications business to a transformation partner by building our organization as a platform and putting our people first.

We are beginning to see the fruits of these efforts, but we know we are only in the middle of our transformation journey, as it is a profound change, in a highly volatile market. That is why, even though we have some preliminary encouraging signs, we remain very cautious and determined to win.

We are convinced that we have an unparalleled position in the market through both our ability to help clients with marketing transformation and digital business transformation. We are committed to achieving our transformation which will put us in a position to drive a significant improvement in organic growth and financial performance.

I look forward to seeing you at our investor day on March 20, 2018.”

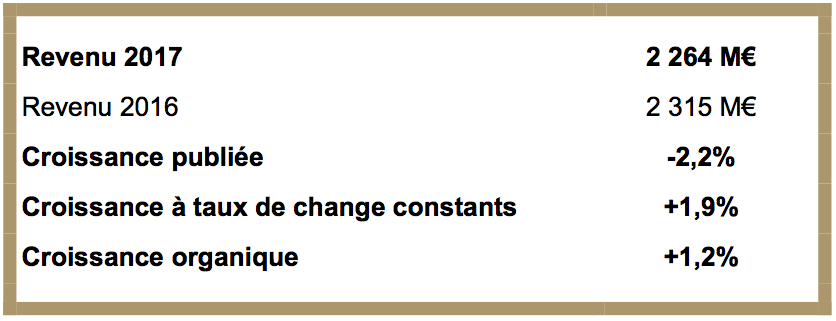

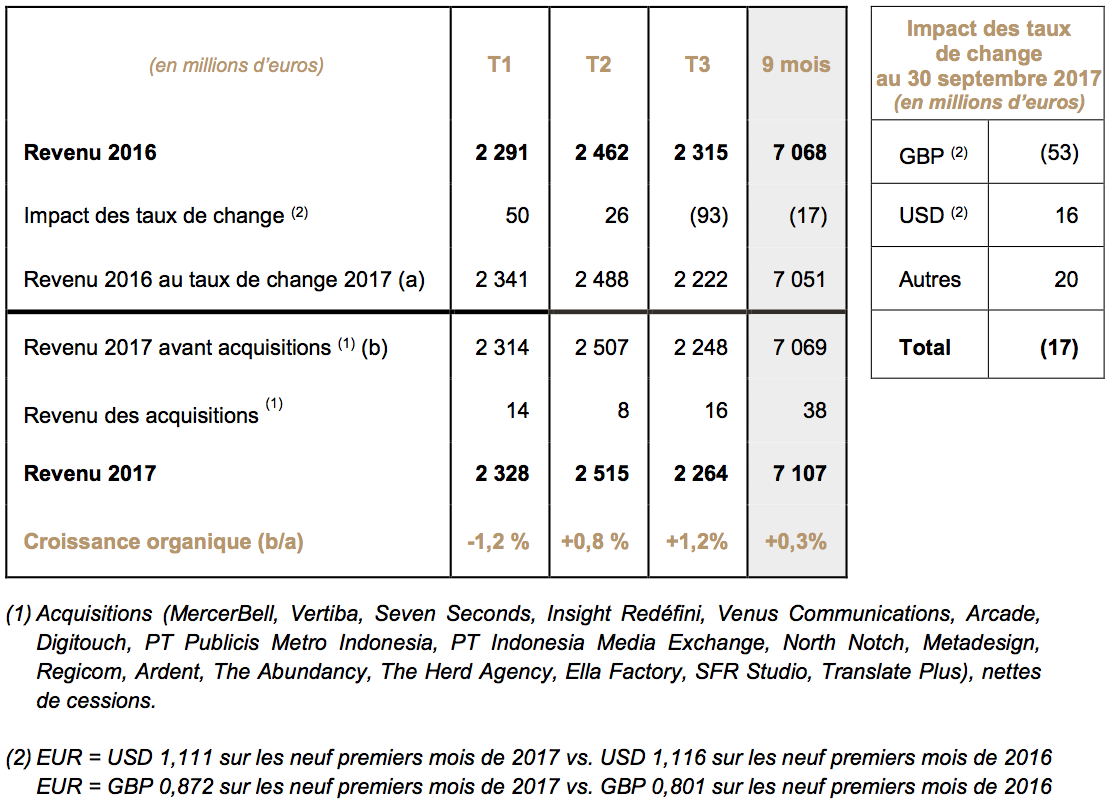

Publicis Groupe’s consolidated revenue in Q3 2017 was 2,264 million euro, down 2.2% from 2,315 million euro for the corresponding period in 2016. Exchange rates had a 93-million euro negative impact, i.e. the equivalent of 4.0% of revenue in Q3 2016. Net acquisitions contributed 16 million euro to revenue for the period, i.e. the equivalent of 0.7% of revenue in Q3 2016. Growth at constant exchange rates was +1.9%.

Organic growth stood at +1.2% in the third quarter. As expected, this was an improvement on the Q2 organic growth rate of +0.8%. The Groupe benefited from the ramp-up of contributions from accounts gained since Q2 2016, in particular those of Walmart, USAA, Asda, Motorola and Lowe’s. As announced, organic growth remained impacted by the SapientRazorfish restructuring and the impact on revenue of the ending of non-profitable contracts.

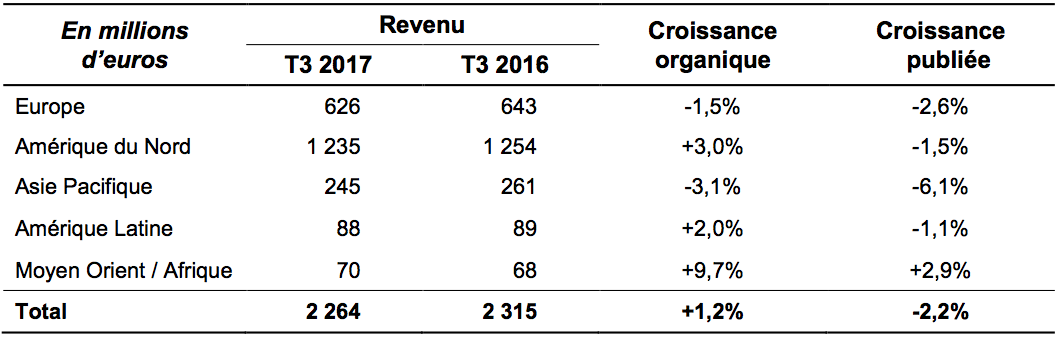

Breakdown of Q3 revenue by regio

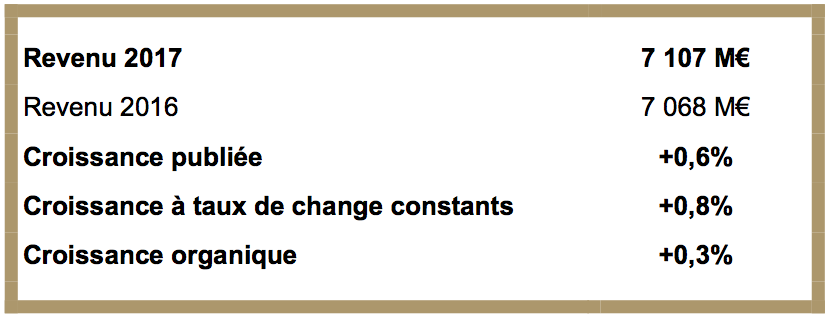

At September 30, 2017, Publicis Groupe’s year-to-date revenue stood at 7,107 million euro after 7,068 million euro in 2016, i.e. an increase of 0.6%. Exchange rates adversely affected revenue by 17 million euro, i.e. the equivalent of 0.2% of revenue for the first nine months of 2016. Net acquisitions contributed 38 million euro to revenue at September 30, 2017, i.e. the equivalent of 0.5% of revenue from the corresponding period in 2016. Growth at constant exchange rates was 0.8 %.

Organic growth stood at 0.3% at September 30, 2017.

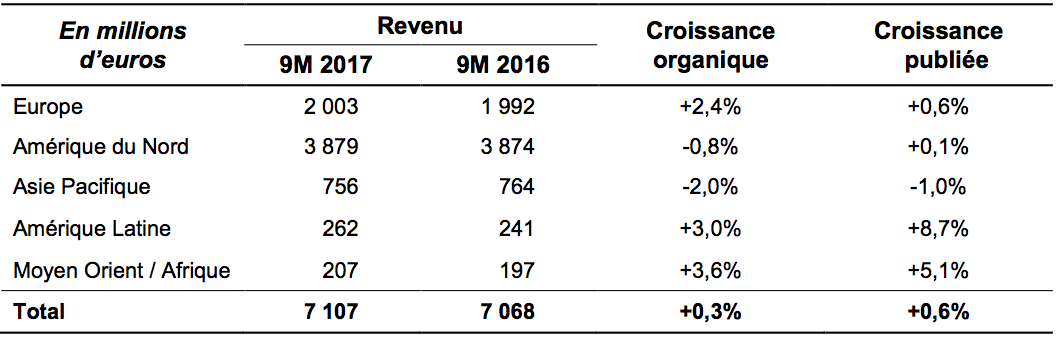

Breakdown of revenue by region at September 30

Europe grew by 0.6%. After factoring out the impact of acquisitions and exchange rates, organic growth was +2.4%. France performed well (+2.4%), while the UK and Italy posted strong momentum at +6.2% and +8.8% respectively. However, Germany recorded negative growth of -5.0% against a very difficult comparable period in 2016. In Q3 2017, Europe reported organic growth of -1.5% after an upswing of +4.3% at June 30, 2017. On top of few account losses, this downturn had to be put in the context of a challenging comparable period in Q3 2016 when organic growth was close to 8%. This is also why the main European countries have slowed significantly by comparison with June 30, 2017.

North America achieved organic growth of +3.0% in Q3 2017, accelerating away from its +0.2% growth rate in Q2 thanks to the ramp-up of accounts gained since the summer of 2016 (including Lowe’s, Walmart, USAA) and the benefit of early 2017 account wins (among which MolsonCoors and FirstNet), partly offset by the growth challenges of the FMCG sector. As announced, growth is nonetheless affected by the restructuring of SapientRazorfish as well as by the impact on revenue of unprofitable accounts that have been discontinued. Over the first nine months of 2017, organic growth remained in negative territory (-0.8%). On a reported basis, growth stood at +0.1%.

Asia Pacific reported -1.0% and organic growth of -2.0% for the first nine months. China only grew by +0.4% due to difficulties at one entity under strategic review. Business grew by 9.5% in Singapore. In India, the situation is consolidating: after +0.4% in Q1 and +13.0% in Q2, the third quarter saw further growth of +3.9%.

Latin America rose by +8.7% (+3.0% on an organic basis). In Brazil, revenue fell -0.8% at September 30, after +1.0% at June 30, due to the difficulty in outperforming 2016 when Brazil hosted the Olympic Games in Rio. Mexico continued its strong growth trend with +12.2%.

The Middle East & Africa reported growth of +5.1% (organic growth of +3.6%).

Net debt totaled 2,291 million euro at September 30, 2017 (i.e. a net debt / equity ratio of 0.41), compared with 1,244 million euro at December 31, 2016. The Groupe’s average net debt over the first nine months of 2017 was 2,066 million euro, down from 2,443 million euro at September 30, 2016.

Governance and nominations

Since June 1, 2017, Maurice Levy has taken on the role of Chairman of the Supervisory Board, of which he is also a member. Arthur Sadoun has been appointed CEO and Chairman of the Management Board. The Management Board (Directoire) has been reinforced by the arrival of Steve King, CEO of Publicis Media, who has teamed up with Jean-Michel Etienne, Executive Vice-President, Finance, and Anne-Gabrielle Heilbronner, Secretary General.

Since August 24, 2017, in addition to her existing responsibilities, CSR and The Women’s Forum for the Economy and Society have been placed under the remit of Anne-Gabrielle Heilbronner. Headquartered in Paris, the Women’s Economic Forum is a Publicis Groupe company and the world’s leading platform, where women voice their opinions on major social and economic issues. The Women’s Forum for the Economy and Society is dedicated to showcasing the talent and creativity of women while fostering international cooperation. The yearly Women’s Forum Global Meeting, which is held in France and brings together more than 1,500 participants, has become an unmissable date on the international conference calendar: the place to be and to be heard. The next Global Meeting will take place in Paris, October 5-6, 2017. The Women’s Forum is one of the key components of Publicis Groupe’s commitment to CSR. The Groupe’s goal is to provide outstanding solutions that represent its strong values of diversity, ethical practices and respect for the environment to have a positive social impact and promote responsible marketing, in terms of social representation, transparency and data protection.

Véronique Weill has joined Publicis Groupe as General Manager, in charge of Re:Sources, IT, real estate, insurance and M&A. Véronique previously spent 21 years with JPMorgan, mainly in the USA, where she was in charge of operations and IT globally. She then joined Axa in 2006, where, as a member of the Management Committee, she focused on operations, technology, digital, marketing and innovation. As Axa’s Chief Operating Officer and subsequently Chief Customer Officer, she helped make Axa one of the world’s leading insurance brands.

Emmanuel André has also joined the Groupe at the newly-created position of Chief Talent Officer (CTO). Based in New York, Emmanuel André is in charge of talent management and recruitment, working directly with the four Solutions CEOs and their respective CTOs who report directly to him. He is also in charge of all Groupe learning, training and development programs. He has also been appointed to the Management Committee and will report directly to Arthur Sadoun, CEO and Chairman of the Management Board. Former President of TBWA Worldwide, Emmanuel André previously managed HR strategy at global level, spanning the key areas of learning, career development, top talent recruitment and corporate culture at large. He began his career in advertising in 1993 and has worked for TBWA in Paris, Hong Kong and then New York.

Carla Serrano, CEO of Publicis New York and Chief Strategy Officer of Publicis Communications, has been promoted to Chief Strategy Officer at Publicis Groupe. Throughout her career, Carla has held strategic management positions in large networks and creative agencies. Before joining Publicis, Carla was CEO of Naked NA, CSO of TBWA Chiat/DAY NY and Chair at Berlin Cameron and Partners.

Publicis Groupe has set up two new management committees, in addition to its Management Board (Directoire). The first is the Executive Committee and is in charge of the Groupe’s transformation. It meets every month and is comprised of the following members, in addition to the members of the Management Board:

The second committee, known as the Management Committee, meets every quarter and oversees Groupe operations and execution of its strategy. It is comprised of the Executive Committee members plus the following:

On September 27, 2017, Publicis Groupe announced Annette King will be appointed CEO of the UK for Publicis Groupe. Annette will report directly to Arthur Sadoun, Chairman & CEO of Publicis Groupe and will join the Management Committee. In her role as CEO of Publicis Groupe UK, Annette will oversee all of Publicis Groupe‘s operations in the market, from Publicis Communications, to Publicis Media, Publicis.Sapient and Publicis Health. She will be responsible for ensuring that the Groupe brings to life its vision of being its clients’ indispensable partner in their transformation. In this endeavour, Annette can count on the help of Steve King who will act as Executive Sponsor in the UK. Annette will come to Publicis Groupe from the Ogilvy Group (WPP) where she worked for seventeen years, in eight different roles, ranging from client lead on American Express across EMEA to Managing Director for Ogilvy Interactive and from New Business Director for OgilvyOne to her latest role as CEO of Ogilvy Group in the UK.

External growth

In January 2017, Publicis Communications acquired two digital agencies via Leo Burnett, namely The Abundancy and Ardent. These agencies will add to Leo Burnett’s arsenal of data, creative and technological capabilities. Ardent provides proprietary technology that uses search data to understand behavior and predict consumer intent, while The Abundancy applies these learnings to inform customer content. Together, these two agencies count 60 professionals who have now joined Leo Burnett under newly appointed CEO Andrew Swinand in the USA.

In July 2017, Publicis Communications announced the acquisition of The Herd Agency, one of Australia's largest and most-awarded public relations agencies. The acquisition enables Publicis Communications to provide clients with newly expanded public relations services, including: strategy, corporate affairs, earned media, stakeholder relations, integrated campaigns, issues and crisis management, social media and content marketing. The Herd Agency will be aligned with MSLGroup in Australia.

In August 2017, Prodigious - Publicis Communications’ production platform - announced the acquisition of Translate Plus, a leading global language services provider with expertise in “transcreation”. “Transcreation”, which entails completely adapting the brand message of a product or advertisement to a target market, will play an integral part in our global advertising campaigns. Translate Plus, which was founded in 2008, counts over 130 employees across ten international offices in London, the Netherlands, Germany, Denmark, Sweden, Italy, Bulgaria, Washington DC, China and Japan. Its client portfolio includes Mondelez, Porsche Consulting, Reckitt Benckiser, Rentalcars and Ricoh.

Finance

On March 13, 2017, Publicis Groupe entered into a share buyback agreement with an Investment Services Provider under the share buyback program authorized by the Shareholders’ meeting of May 25, 2016. The buyback period extended from March 14, 2017 to June 30, 2017.

At the end of the contract, 5,000,000 shares were purchased at an average share price of 64.69 euro per share (64.89 euro including tax on financial transactions).

The first nine months of 2017 showed encouraging signs with, on the one hand, Publicis Groupe returning to positive growth in the second quarter and, as we expected, posting a slight sequential improvement in the third quarter, and on the other hand, a favorable account win momentum which includes prestigious gains such as Diesel, Southwest, Lionsgate and McDonald’s.

The Groupe’s top priority is to improve its organic growth and there are quite a number of projects still on-going. Our ambition is to post higher growth than our competitors by becoming the leader in marketing and digital business transformation. Four concrete decisions have been taken for this purpose: make our model a reality for all our clients, leverage our competitive advantage in technology and consulting, simplify the structure of our own organization for the purposes of greater efficiency, and establish a corporate culture to attract and retain the top talents. Regarding the latter, great strides forward have been made in the third quarter, in particular with the arrival of Emmanuel André as the Groupe’s Chief Talent Officer and the announcement of the arrival of Annette King as CEO of Publicis UK.

We expect better organic growth in the second half of 2017 by comparison with the first half of the year. The longer term goals are well known, i.e. to enhance growth and improve efficiency. The Groupe is in the early stages of rolling out a new business plan with the new management team. A detailed update will be provided in the forthcoming months.

Certain information contained in this document, other than historical information, may constitute forward-looking statements or unaudited financial forecasts. These forward-looking statements and forecasts are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These forward-looking statements and forecasts are presented as at the date of this document and, other than as required by applicable law, Publicis Groupe does not assume any obligation to update them to reflect new information or events or for any other reason. Publicis Groupe urges you carefully to consider the risk factors that may affect its business, as set out in the Registration Documents filed with the French Autorité des Marchés Financiers (AMF) and which is available on the website of Publicis Groupe (www.publicisgroupe.com), including an unfavorable economic climate, an extremely competitive market sector, the possibility that our clients could seek to terminate their contracts with us at short notice, the fact that a substantial part of the Group’s revenue is derived from certain key clients, conflicts of interest between advertisers active in the same sector, the Group’s dependence on its directors and employees, laws and regulations which apply to the Group’s business, legal action brought against the Group based on allegations that certain of the Group’s commercials are deceptive or misleading or that the products of certain clients are defective, the strategy of growing through acquisitions, the depreciation of goodwill and assets listed on the Group’s balance sheet, the Group’s presence in emerging markets, exposure to liquidity risk, a drop in the Group’s credit rating and exposure to the risks of financial markets.

Organic growth calculation

Bradesco (Brazil), Petrobras (Brazil), eBay (France), Nokia (South Africa), Uber (Singapore), Singtel (Singapore), Marriott (USA), SNHU (USA), Chromebook (USA), Truecaller (Sweden), Match.com (Meetic) (Pan-Europe), Great West Life (Canada), USAA (USA), AkzoNobel (Global), Culligan (water filtration/conditioning systems) (USA), Service Civique (France), Sunrise (Switzerland), Britvic (UK), Asics (Global), Anheuser-Busch InBev (USA)

20th Century Fox (Australia), Aldi Stores Limited (Australia), Coty Luxury (Denmark), Ego (Australia), Expedia (Singapore), KFC (USA), Lowe's (USA), Mattel (USA), Merck (EMEA), Molson Coors (USA & UK), NBCF (National Breast Cancer Foundation) (USA), PartyPoker (Norway), Royal Caribbean Cruises (UK), Singapore Tourism (Global), Southern Cross Travel Insurance (Australia), Bel Group (Global), Carpetright (UK), CCU (Compania de las Cervecerias Unidas) (Argentina), Coty Luxury (Norway), Credit Suisse Group (Italy), Danks Hardware (Australia), Dubai Corporation for Tourism & Commerce Marketing (Middle East), Euroloan Consumer Finance (Poland), Fondazione Ania (Italy), Grupa Allegro (Poland), H&R Block (USA), JC Jeans & Clothes (Sweden), Kolonial.no (Norway), Luminous Power Technologies (India), Materialgruppen AB Kimberly-Clark (Sweden), P&G (UK), PayU India (India), Procter & Gamble (UK & Ireland), ZTE Mobile (India), Alibaba (Tmall) (China), AOK-Bundesverband (Germany), Codorniu (Spain), Cubus (Nordics), Cubus (Sweden), Dressmann (Norway), Fondazione Ania (Italy), Godrej & Boyce (India), Lenskart (India), Mattress Firm (USA), Profile Pensions (United Kingdom), R+V Versicherung AG (Germany), Southwest Airlines (USA), Storck (Germany), Telkom (South Africa)

Mattel (USA), Carnival Corporation (USA), FirstNet / AT&T Government Solutions (USA), Lyft (USA), GSK (USA), The Nature Conservancy (USA), Intermarche (France), Oshawa (Canada), W.L. Gore & Associates (Germany), British Gas (UK), McDonalds Corporation (USA), McDonalds Deutschland LLC (Germany)

OCBC (Malaysia), Reckitt Beckenzier (Malaysia), 20th Fox Century (Malaysia), Ikea (Czech Republic), BEL (Czech Republic), l’Oréal (Czech Republic), Société Générale (Serbia), P&G (The Nertherlands), FCA (The Nertherlands), Skoda (The Nertherlands), Aldi (Belgium), Informazout (Belgium), ABinBEV (Colombia), Renault (Argentina), SGEBS (Romania), Coca Cola (Romania), Franke (Romania), KBC (Bulgaria), Merck (Czech Republic), Silvano (Czech Republic), VISA (Czech Republic), Kraft/Heinz (Czech Republic), Vileda (Czech Republic), SAB Miller (Czech Republic), Plzensky prazdroj, s.r.o. (Czech Republic), Generali (Czech Republic & Slovakia), Cordblood (Slovakia), Unicef (Serbia), Momondo (Turkey), Yaşar Holding (Turkey), Visa (Turkey), Νestle (Greece), Delacre (Belgium), Recticel (Belgium), ING Sprinters (Netherlands), ASR (Netherlands), JVH Gaming (Netherlands), Charlie Temple (Netherlands), Binck Bank (Netherlands), Nutricia (Netherlands), Expedia (Malaysia), Singapore Tourism Board (Thailand), Inbev (Colombia & Peru)

Novartis (USA), Genentech (USA), Shire (USA), Adapt (USA), AMAG (USA), Sunovion (USA), Clinigen Group (Global), Purdue (USA), Merck & Co (USA), Intarcia Therapeutics (USA), Flexion Therapeutics (USA), AbbVie (USA), Ipsen (USA), Emmaus Life Sciences (USA), Ultragenyx Pharmaceutical (USA), AcelRx Pharmaceuticals (USA), Merck KGaA (USA), Roche (UK), AstraZeneca (USA), Hospital Corporation of America (USA), Stryker Corporation (USA), Swanson Health Products (USA)

09-01-2017 - Publicis Communications: Appointment at Leo Burnett USA and two acquisitions in digital

11-01-2017 - Publicis Communications: Appointment at Saatchi & Saatchi; Robert Senior leaves the Groupe

18-01-2017 - Publicis One: Appointment in Japan

19-01-2017 - Publicis One: Appointment in Turkey

26-01-2017 - Governance announcement at Publicis Groupe

01-02-2017 - Publicis Communications: Appointment for the Nordics region

03-02-2017 - Publicis.Sapient: Appointment at DigitasLBi; Luke Taylor leaves the Groupe

07-02-2017 - Appointment of Laurent Carozzi as Publicis Groupe’s Chief Performance Officer

09-02-2017 - 2016 annual results

21-02-2017 - Viva Technology: 2nd edition on June 15-17, 2017

13-03-2017 - Share Repurchase Agreement

16-03-2017 - Publicis.Sapient: launch of SapientRazorfish’s integrated offering

22-03-2017 - Partnership between Publicis Groupe and Microsoft

18-04-2017 - Appointment of Agathe Bousquet as President of the Groupe in France

20-04-2017 - Q1 2017 Revenue

09-05-2017 - Appointment of Céline Fronval as Publicis Groupe’s General Counsel

31-05-2017 - Combined General Shareholders' Meeting

14-06-2017 - Publicis Groupe Boosts Management Structure with Two Senior Nominations and New Governing Bodies

19-06-2017 - Publicis Groupe and Alibaba Announce China Uni Marketing Partnership

20-06-2017 - Publicis Groupe Builds the First Professional Assistant Platform Powered by AI and Machine Learning

20-07-2017 - H1 2017 Results

24-07-2017 - Publicis One: Appointment in Panama

04-08-2017 - Acquisition of Translate Plus by Prodigious

21-08-2017 - Appointment of Emmanuel André as Publicis Groupe’s Chief Talent Officer

24-08-2017 - Anne-Gabrielle Heilbronner, member of the Directoire and Groupe Secretary General, takes ESG and the Women’s Forum for Economy and Society under her responsability

20-09-2017 - The next edition of Viva Technology will be held from on May 24-26, 2018 in Paris

EBITDA: operating margin before depreciation.

Operating margin: Revenue after personnel costs, other operating expenses (excl. non-current income and expense) and depreciation (excl. amortization of intangibles arising on acquisitions).

Operating margin rate: Operating margin as a percentage of revenue.

Headline Group Net Income: Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals and revaluation of earn-out payments.

EPS (Earnings per share): Group net income divided by average number of shares, not diluted.

EPS, diluted (Earnings per share, diluted): Group net income divided by average number of shares, diluted.

Headline EPS, diluted (Headline Earnings per share, diluted): Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals and revaluation of earn-out payments, divided by average number of shares, diluted.

Capex : Net acquisitions of tangible and intangible assets, excluding financial investments and other financial assets.

ROCE (Return On Capital Employed): Operating Margin after Tax (using Effective Tax Rate) / Average employed capital. Capital employed include Saatchi & Saatchi goodwill which is not recognised in consolidated accounts under IFRS.

Free Cash Flow before changes in working capital requirements: Net cash flow from operating activities before changes in WCR linked to operating activities.

Net Debt (or financial net debt): Sum of long and short financial debt and associated derivatives, net of treasury and cash equivalents.

Average net debt: Average of monthly net debt at end of month.

Dividend pay-out: Dividend per share / Headline diluted EPS.

Publicis Groupe [Euronext Paris FR0000130577, CAC 40] is a global leader in communication. The Groupe is positioned at every step of the value chain, from consulting to execution, combining marketing transformation and digital business transformation. Publicis Groupe is a privileged partner in its clients’ transformation to enhance personalization at scale. The Groupe relies on ten expertise concentrated within four main activities: Communication, Media, Data and Technology. Through a unified and fluid organization, its clients have a facilitated access to all its expertise in every market. Present in over 100 countries, Publicis Groupe employs around 114,000 professionals.

Jean-Michel Bonamy

Deputy CFO

Amy Hadfield

DIRECTOR OF GLOBAL COMMUNICATIONS